Why Australia Will Never Build Enough Homes

Published 7:13 am 22 Apr 2024

Welcome to this week’s edition of the Property Edge newsletter. As we navigate through a rapidly evolving property landscape, this issue brings you a comprehensive analysis of pressing topics that shape the Australian housing market. From critical insights into the challenges of meeting national housing targets to the implications of ongoing inflation and the escalating rental crisis, we delve into the factors influencing both the market and policy decisions. Stay informed with our weekly summary that not only explains current trends but also forecasts future opportunities.

Why Australia Will Never Build Enough Homes

Despite ambitious government targets, the relevant data reveals that Australia faces challenges in meeting its housing construction goals. Here’s why:

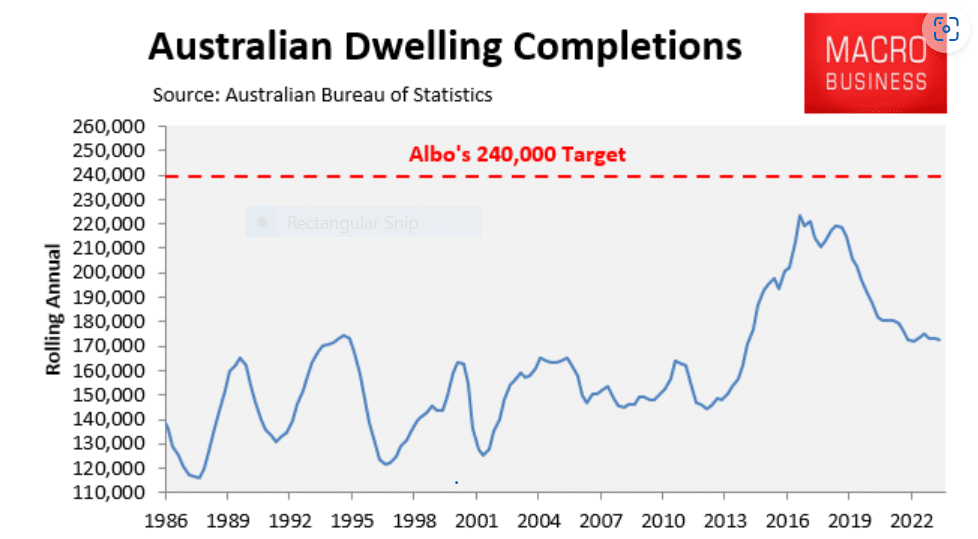

The Albanese government aims to build 1.2 million homes over the next five years, necessitating an unprecedented construction pace.

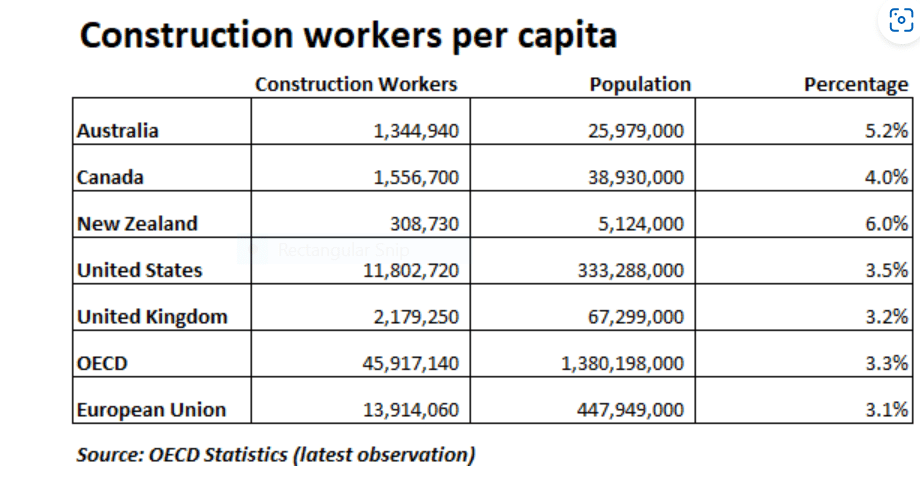

This is unfolding against a background where Australia already has one of the highest concentrations of construction workers globally, with 5.2% of the population involved in the sector, according to OECD data, compared to the OECD average of 3.3%.

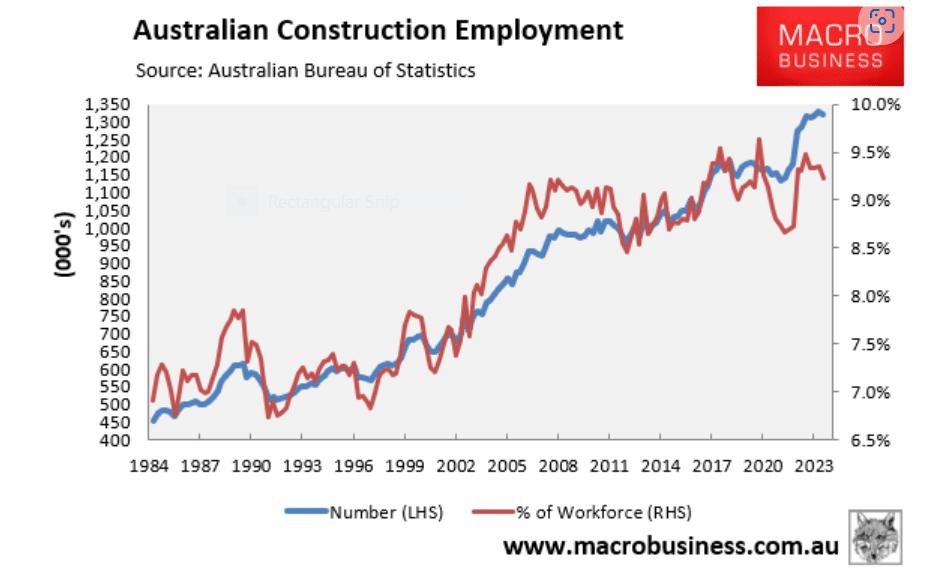

Australian Bureau of Statistics figures from February 2024 reveal that 9.2% of the workforce is employed in construction, a historic peak.

Now also must bear in mind that the demands on the construction sector don’t just involve building homes; significant infrastructure such as roads, schools, and hospitals must also be constructed. This will require diverting more workers into construction, intensifying competition for labour, especially with state government infrastructure projects. So it is not just a housing supply issue but is compounded by a labour supply shortage in the construction industry.

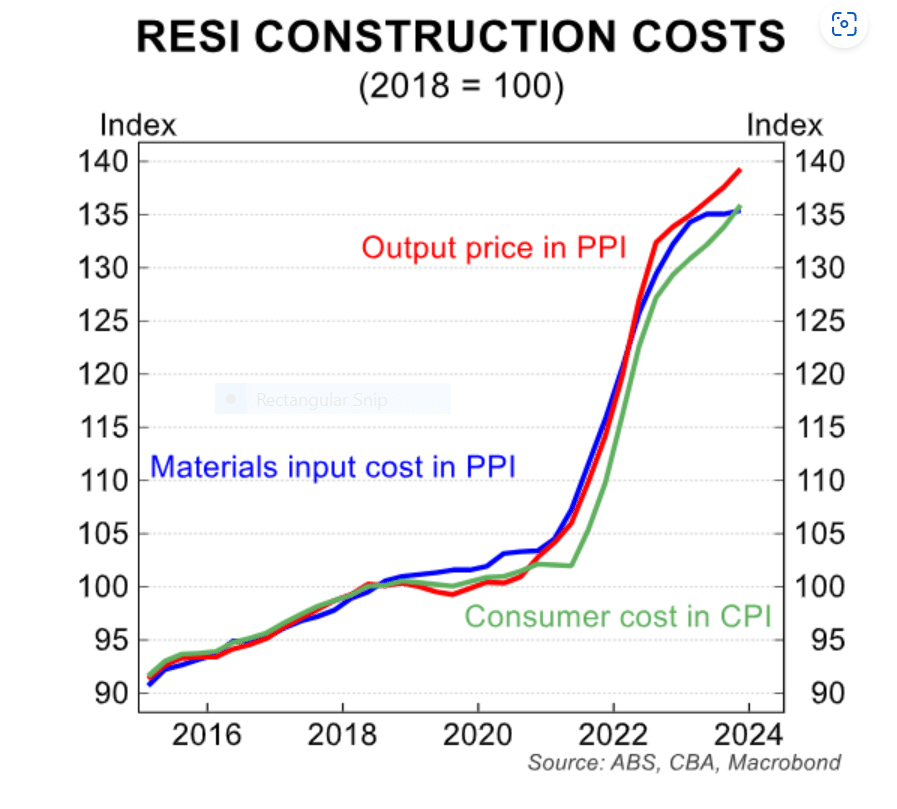

The construction sector has also seen costs surge by 30% to 40% during the pandemic, which has impacted both demand and supply.

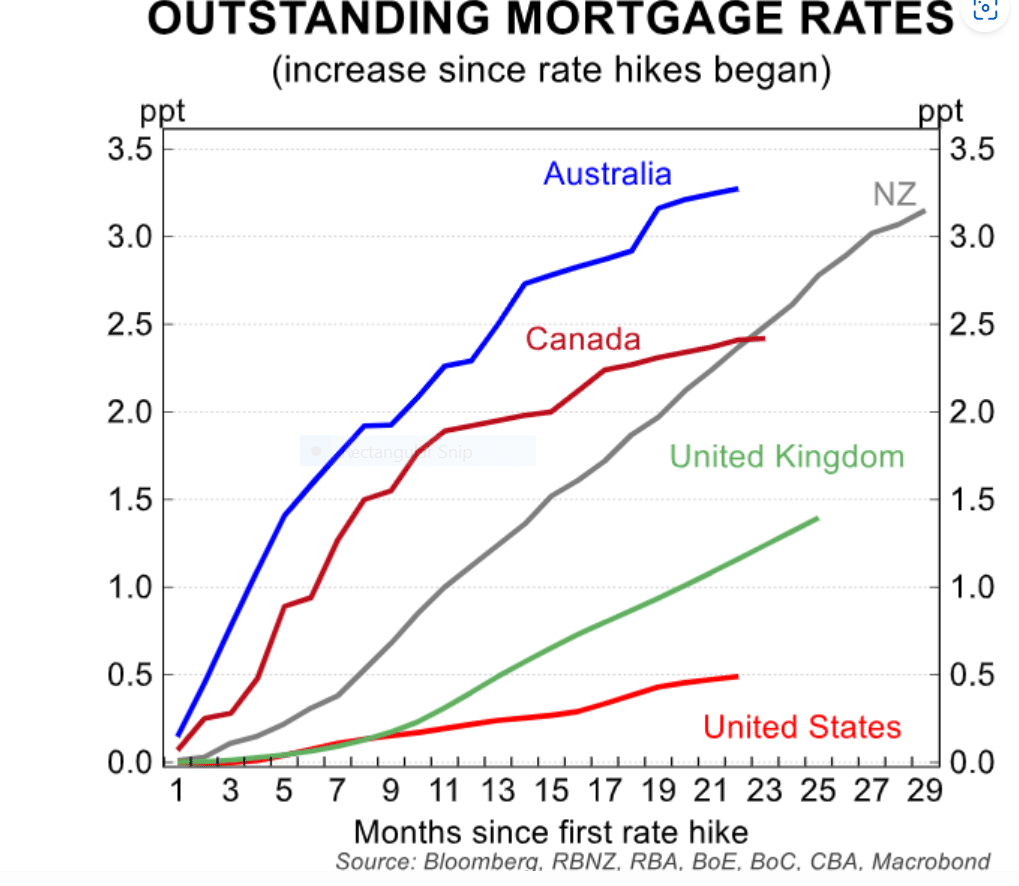

Additionally, high interest rates in Australia continue to suppress both demand and supply in the housing market.

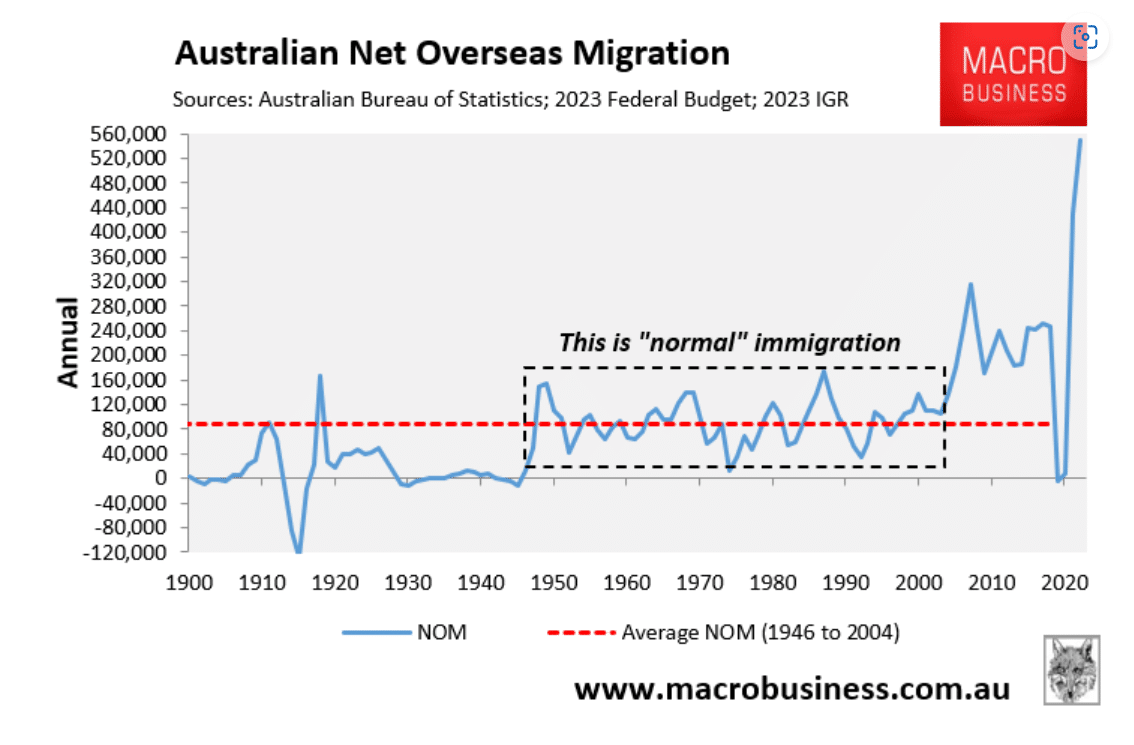

In conclusion, without a substantial increase in construction capacity and a reduction in net overseas migration, Australia may struggle to build enough homes to keep pace with its growing population.

Unfortunately, whilst we can set whatever targets we want for housing supply but when the fundamental requirements for building those houses don’t align then it isn’t going to happen and we will constantly be chasing our tail.

Interest Rate Hikes Have Strained Australian Businesses

High rates and runaway inflation has also led to a strain on Australian businesses according to new findings based on research from the International Monetary Fund.

CreditorWatch data indicates a significant rise in financial distress among businesses, with external administrators appointed to Australian companies 22 percent more frequently than in 2023. This increase is notably severe in the construction sector, which accounts for almost 24 percent of these administrations.

The irony in this situation, is that the construction industry is crucial for addressing the ongoing housing crisis. The combination of limited housing availability, escalating property prices, and tightening family budgets due to higher interest rates are pushing businesses, particularly in construction, to breaking points, complicating efforts to alleviate the housing shortage.

IMF Predicts Continued Economic Downturn for Australia

The International Monetary Fund (IMF) has forecasted a grim economic trajectory for Australia, as detailed in its latest World Economic Outlook. Australia’s GDP per capita fell by 1.0% in 2023, reflecting broader economic challenges.

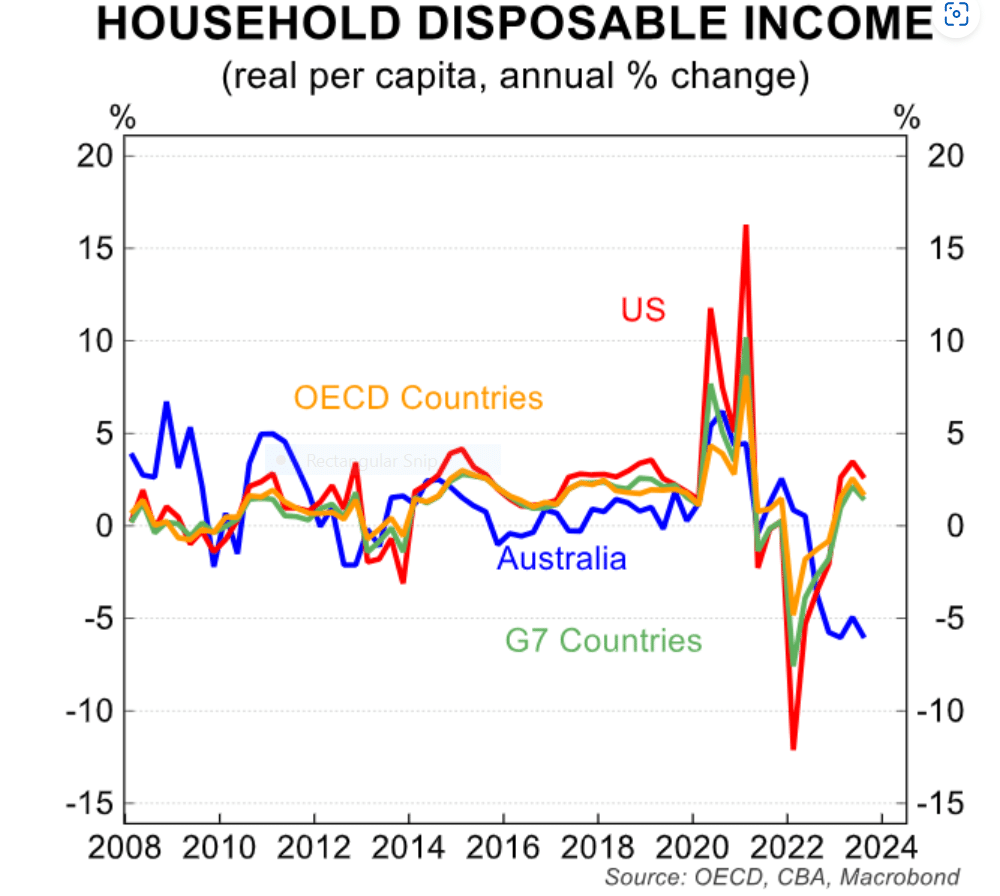

In tandem, real per capita household final consumption decreased by 2.5% in 2023, contributing to a 0.3% annual reduction in per capita final demand.

Moreover, real per capita household disposable income saw a significant drop of 6% in 2023, positioning Australia among the worst globally in this regard.

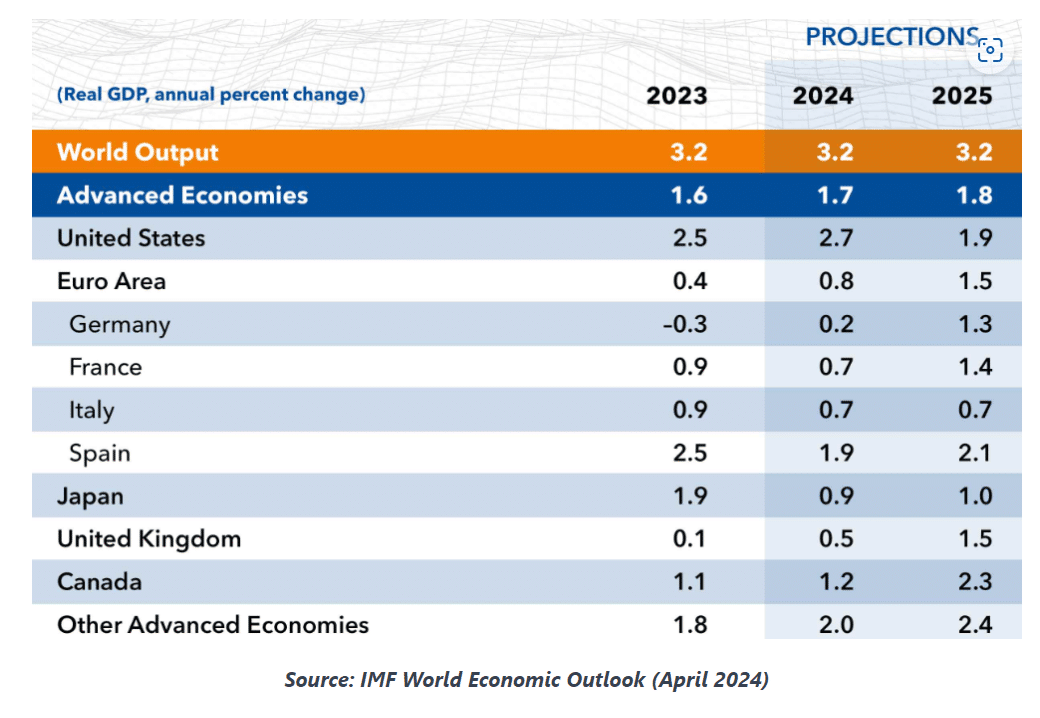

The IMF projects a modest economic growth of 1.5% for Australia in 2024, accelerating slightly to 2% in 2025. Despite these figures, Australia’s growth is expected to lag behind other advanced nations this year, although it might slightly surpass them next year.

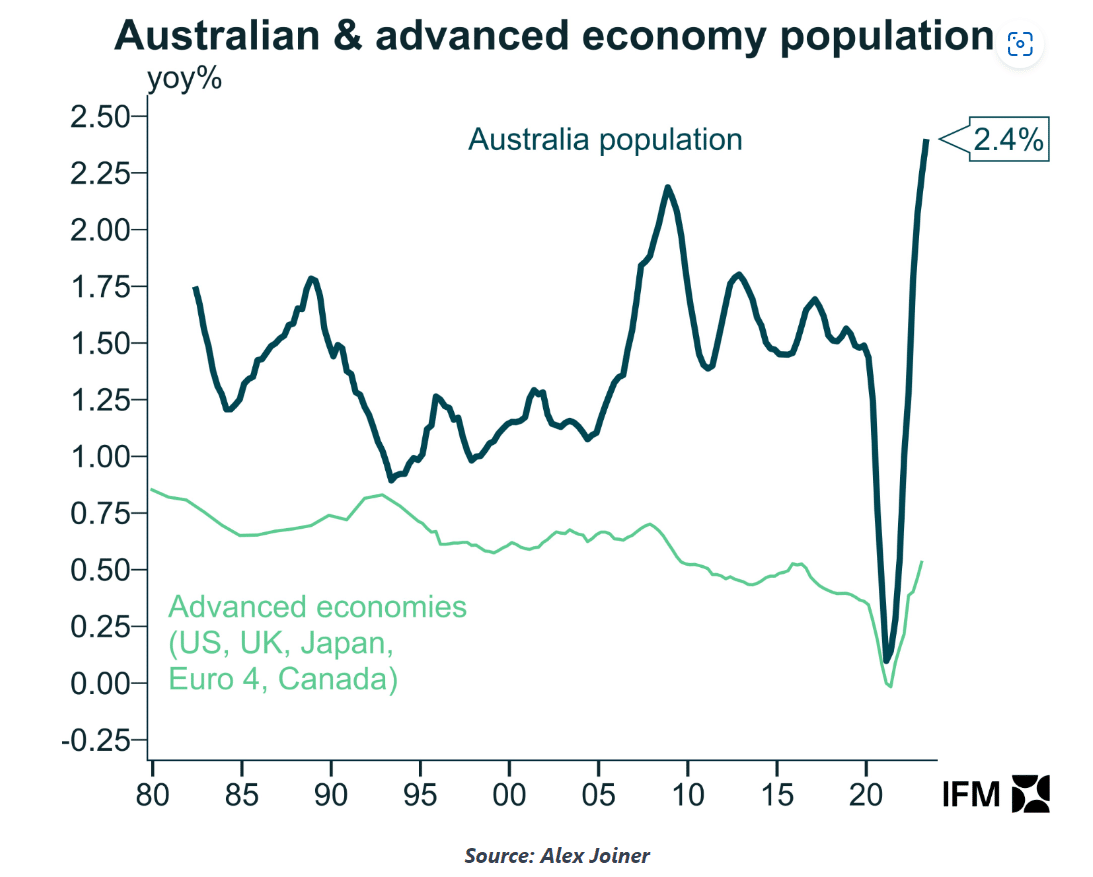

A key factor exacerbating Australia’s economic woes is its higher population growth rate compared to other developed countries, which dilutes per capita metrics further.

This scenario suggests that despite nominal economic growth, Australians may experience a per capita recession for the second consecutive year due to high population growth driven by aggressive immigration policies.

This complex economic situation underscores significant challenges ahead for Australia, as nominal gains are offset by per capita declines, painting a stark picture of the underlying economic health.

Australia’s Escalating Rental Crisis: A Deep Dive into the Drivers

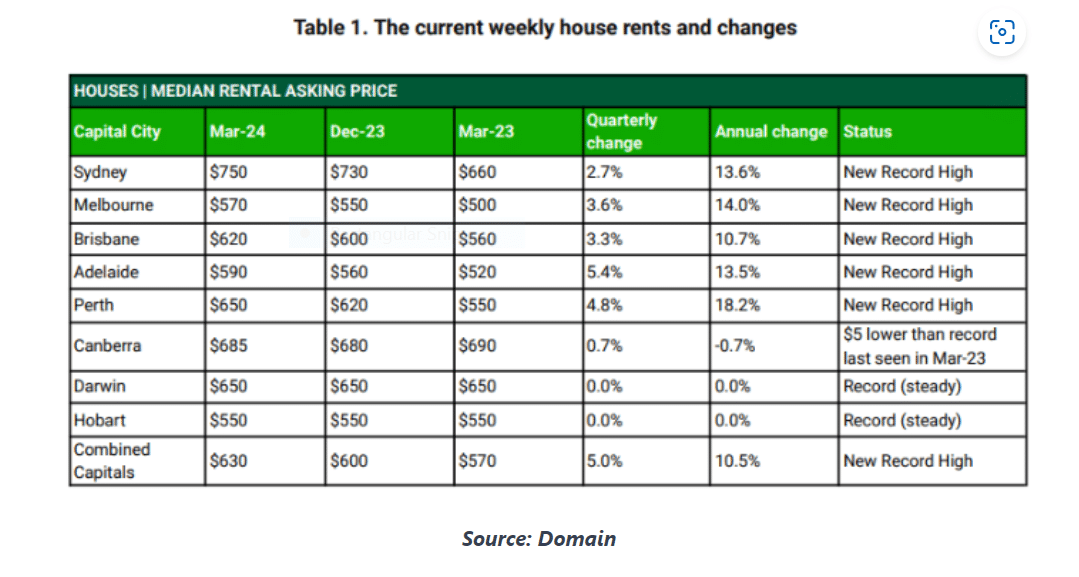

According to the latest Domain report, capital city house rents experienced a significant 5% surge in the March quarter of 2024, marking the largest quarterly increase in 17 years. Unit rents weren’t far behind, recording a 3.3% rise, continuing an upward trend for an unprecedented 11th consecutive quarter.

The crux of the crisis lies in the imbalance between the high population demand and the lagging supply of housing, which has driven rental vacancy rates to record lows and rents to record highs.

PropTrack data indicates a 38% increase in rents since the pandemic onset, illustrating the depth of the rental affordability issue.

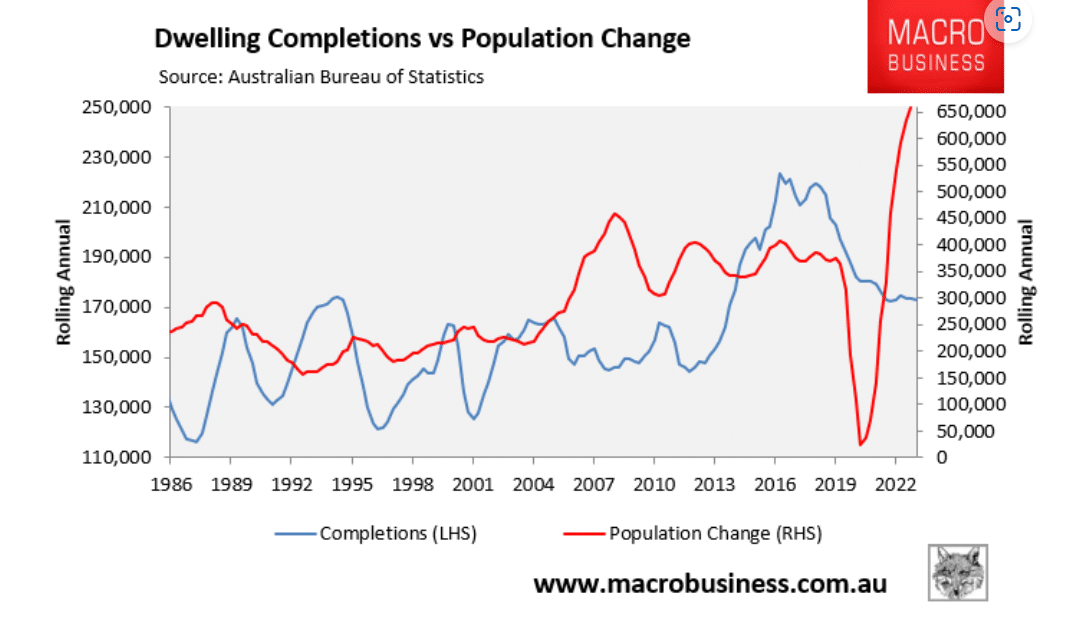

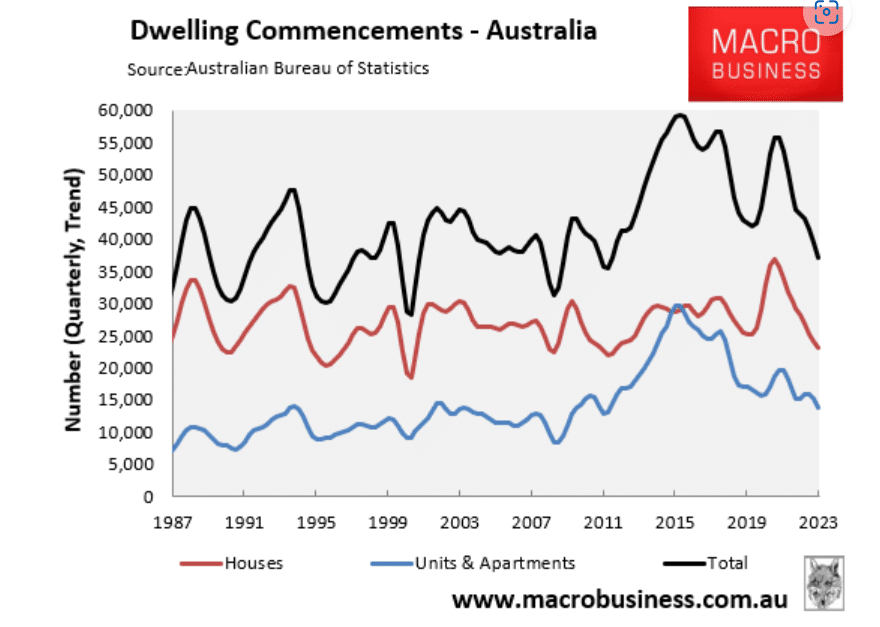

The latest ABS figures on dwelling commencements paint a grim picture, with only 37,200 homes commenced in the December quarter of 2023 — the lowest since 2012. This shortfall puts the annual run rate at 149,000 homes, severely trailing behind the government’s target of 240,000 homes per year.

In New South Wales alone, the rate of new home commencements is drastically insufficient to meet the needs of its growing population, with only one new home per 4.3 new residents.

Similarly, dwelling approval figures remain low, with only 149,000 homes approved on an annualised basis as of February 2024, indicating that housing supply constraints will persist.

The scenario is exacerbated by soaring construction costs and a competitive labour market, where home builders vie for workers against large-scale infrastructure projects. This environment has not only stifled the ability to meet housing demands but has also led to increased instances of builder insolvencies.

In conclusion, Australia’s rental crisis is set to worsen, driven by a confluence of high population growth, constrained supply, and flawed policy decisions. This perfect storm is pushing more Australians into financial stress, shared housing, and, in the worst cases, homelessness.

Thank you for joining us in this week’s exploration of Australia’s property market dynamics. As we dissect the complex interplay between construction, policy, and economic pressures, our aim is to equip you with the knowledge to navigate these turbulent times and indeed profit because of them. Looking ahead, we will continue to monitor these developments, providing you with timely and accurate insights to make informed decisions. Remember, when it comes to property there are no “good”or “bad” markets only opportunities for those who remain informed. See you in the next edition!

PS: NEW WEBINAR ALERT: Want to know how our students are profiting to the tune of multiple 6 figures right now acquiring undervalued distressed properties without finance, any of their own money or even without paying stamp duty or CGT?

At this timely Distressed Property Masterclass, we’ll show you how this is possible.

Register now for FREE! Click here to register.

You May Also like to Read

The 3 Things You Need to Know About This Property Market

Welcome to this month's edition of Property Edge, where we bring clarity and insight to the complex dynamics of Australia's...

Pressing issues affecting homeowners and prospective buyers

Welcome to this week's edition of the Property Edge newsletter. As we navigate the ever-evolving landscape of Australia’s...

Unlocking Potential: Uncovering Hidden Gems in Australia’s Property Market

Welcome to this edition of Property Edge, where we delve into the latest trends and insights shaping the Australian property...

Suburbs on the Rise: Property Searches Indicate Growth Potential

Welcome to the latest edition of Property Edge, where we delve into the dynamic world of real estate. In this issue, we...

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week's edition of Property Edge, where we delve into the current state of the property market through the...

Foreign Investment In Australia’s Residential Real Estate Is On The Rise

Welcome to this week's edition of Property Edge, where we delve into the latest trends and developments in the Australian...