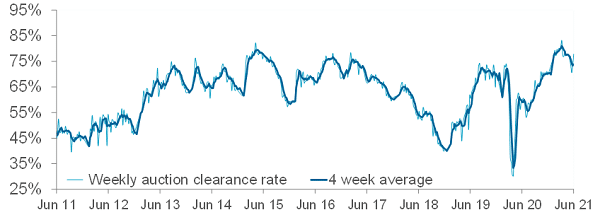

Sydney Auction Clearance Rates Remain High During COVID-19 Spike

Published 6:46 am 20 Jul 2021

Not even fears of COVID-19 seem to be capable of slowing down the thriving property market in Sydney.

Sydney’s latest cluster of COVID-19 cases have done little to dissuade those keen on buying property, as recent data highlights the persistent strength of Sydney’s auction clearance rates.

According to CoreLogic’s preliminary clearance rate statistics for capital cities, Sydney remains the most in-demand spot for auctions with an 82.6% clearance rate, up from 61.6% at the same time last year.

There were a total of 1,174 properties on auction across Sydney over the week, reflecting nearly half of all auctions (2,418) in capital cities throughout Australia. Of Sydney’s auctions, 48.5% were sold prior to the auction, and just 7.7% were withdrawn.

The report goes on to state that this “relatively low withdrawal rate and high preliminary clearance rate” illustrates that “the recent outbreak hasn’t had a material impact on Sydney auction markets.”

The high demand for Sydney properties seems to be insatiable, and continues to persist despite the recent COVID-19 cases as well as rising property values, with the average house in NSW now surpassing $1 million. Sydney’s median dwelling values have climbed 11.2 percent in the past year alone.

The sub-region with the highest clearance rate was Sydney’s inner west, which hit a 94.4% clearance rate over the week. A rundown property in Strathfield, for example, recently went for $5.5 million in an auction – $1.1 million over the reserve price set prior to bidding.

Source: news.com.au

Source: news.com.auBrisbane came in at a close second in auction clearance rates with a 79.1% preliminary clearance rate out of 121 cleared auctions, followed by Canberra who cleared 75 auctions at a clearance rate of 78.1%.

Melbourne, however, did experience a bit of a dip in expectations – likely due to a spike in COVID-19 cases.

786 auctions occurred over the past week in Melbourne, which was a reduction from the 935 that was originally anticipated. CoreLogic’s preliminary data demonstrated a 71.5% clearance rate in Melbourne, which was a decrease from 73% in the week prior.

Source: Core logic

Source: Core logicClearance rates at auctions can be helpful in determining the strength of the property market in each region of Australia, and a high clearance rate shows that the property market is either: high in demand, low in supply or expected to grow. At the moment, Australia’s property market is all of the above.

As such, it should come as no surprise that Australia’s clearance rates remain strong, showing that the demand for property isn’t going anywhere soon.

You May Also like to Read

Why Australia Will Never Build Enough Homes

Welcome to this week's edition of the Property Edge newsletter. As we navigate through a rapidly evolving property...

Unlocking Potential: Uncovering Hidden Gems in Australia’s Property Market

Welcome to this edition of Property Edge, where we delve into the latest trends and insights shaping the Australian property...

Suburbs on the Rise: Property Searches Indicate Growth Potential

Welcome to the latest edition of Property Edge, where we delve into the dynamic world of real estate. In this issue, we...

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week's edition of Property Edge, where we delve into the current state of the property market through the...

Foreign Investment In Australia’s Residential Real Estate Is On The Rise

Welcome to this week's edition of Property Edge, where we delve into the latest trends and developments in the Australian...

How Far Australian House Prices Have Soared Above Fair Value

Welcome to the latest edition of Property Edge, your definitive source for insights into Australia's dynamic real estate...