Latest Housing Data and Trends and The Evolving Economic Landscape

Published 6:32 am 13 Feb 2024

Welcome to this week’s edition of Property Edge, your essential roundup of the latest developments in the property market. As property entrepreneurs, staying informed about market trends and regulatory changes is crucial to navigating the complexities of real estate investment. This week, we delve into significant changes affecting foreign property buyers in Australia, latest housing data and trends and the evolving economic landscape among other insights.

Foreign Buyers Face New Challenges in the Australian Market

Summary: Australia has recently implemented a substantial increase in foreign buyer fees for residential property, aimed at preserving the housing supply for local buyers and tenants. Application costs for purchasing second-hand homes have tripled, and fees for homes left vacant have doubled. These measures, enacted to ensure foreign investment aligns with Australia’s national interest, may deter foreign buyers, particularly from China, who have been a dominant force in the market.

Key Points:

- The Australian government’s latest fee increases are designed to prioritise housing for local residents amidst a backdrop of high prices and a shortage of homes, especially in major cities like Sydney.

- Industry insiders predict that these hikes will divert foreign investors, notably those from China, to markets with lower entry barriers, such as Dubai.

- There’s an expectation that foreign interest, especially from countries like India and Vietnam, will also wane due to the increased costs.

- For foreign investors, the cost of application fees for established homes has nearly tripled for properties priced between A$1 million and A$2 million, amounting to nearly A$85,000 up from A$28,000.

- The vacancy tax has also seen a significant rise, potentially affecting decisions regarding property investment and occupancy.

Implications: These changes underscore a strategic shift in Australia’s approach to managing its housing market, aiming to cool down the fervent activity fuelled by foreign investment. While intended to increase housing availability for locals, there’s a concern that it may lead to reduced project density and fewer new units available, affecting the overall housing supply.

Comparative Analysis: Australia is not alone in adjusting its policies towards foreign property buyers. Singapore, for instance, has also increased stamp duties for foreign buyers to 60% from 30%, indicating a regional trend towards tighter control over foreign investment in residential property.

Summertime Boom: Coastal Suburbs Leading the Pack

Let’s now turn our focus to the vibrant coastal suburbs that have defied seasonal expectations, showcasing robust property price growth during the summer months. A recent study sheds light on these coveted destinations, providing valuable insights for property entrepreneurs eyeing the coastal market.

Summary: Traditionally, spring has been seen as the prime season for property sales, but a trend spanning the last decade reveals that waiting for summer can yield even stronger price growth. According to data from Neoval, backed by Ray White, property price growth averaged 1.8% from December to February across Australia, slightly edging out the spring average and marking summer as a potentially lucrative selling period.

Regional Highlights:

- Byron Bay and Thirroul, NSW: These seaside locales have seen an average price jump of 3% each summer over the past ten years, indicating their enduring appeal to both investors and holidaymakers.

- Noosa Heads and Sunshine Beach, QLD: Close behind, these areas recorded a 2.9% increase, underscoring Queensland’s coastal allure.

- Lorne and Anglesea, VIC: Victoria’s Surf Coast isn’t far behind, with a 2.3% rise, followed by Geelong’s Newtown at 2.2%.

Capital City Standouts:

- In Sydney, Terrey Hills and Castle Hill led with a 3.1% summer price increase.

- Melbourne saw Glen Waverley and Flinders rise by 2.5%.

- Brisbane’s Rochedale and Camp Hill climbed by 2.2%, while Perth’s Cottesloe and Floreat added 1.5%.

Market Dynamics: Despite a cooling property market in 2023, particularly post the November interest rate hike, the scarcity of homes for sale has contributed to price increases in some summer markets. However, the influx of holiday homes on the market in areas like Byron Bay has introduced some pressure. Changes to Airbnb regulations and the rising cost of living are influencing the holiday home market, potentially impacting long-term price trends.

Insights from Industry Experts: Ray White Group’s chief economist, Nerida Conisbee, highlighted the role of limited stock in driving summer price increases. Meanwhile, agents in Byron Bay and Lorne noted a slower market recovery post-pandemic, with potential buyers being more cautious due to interest rate discussions and additional taxes on secondary homes.

Looking Ahead: The scarcity of listings in places like Noosa Heads is keeping price drops minimal, with demand still outstripping supply. The unique dynamic of each coastal suburb, influenced by local and national economic factors, presents both opportunities and challenges for property investors.

Brisbane Breaks Through to the Seven Figure Club

Brisbane has reached a milestone in the Australian property market, leaping into the million-dollar property club. The growth trajectory of Brisbane’s suburbs offers a compelling narrative of change, affordability, and the evolving aspirations of Australian homeowners and investors alike.

Summary: Recent data from PropTrack reveals a significant shift in the Australian property landscape, with the median house price in 95 suburbs nationally climbing above the $1 million mark in 2023. Leading this charge is Brisbane, with 39 of its suburbs newly minted into the million-dollar club, reflecting an unprecedented growth trajectory in Queensland’s capital.

Highlight Suburbs:

- Sunnybank Hills and Sunnybank stand out, with median prices surging by $208,799 (23%) and $204,253 (21%) respectively, showcasing the strongest growth within the city.

Beyond a Million:

- The upscale movement doesn’t stop there; 33 suburbs have crossed the $2 million median house price threshold, and 13 suburbs now enjoy a median price exceeding $3 million.

Driving Factors:

- PropTrack’s senior economist, Paul Ryan, attributes this surge to the quest for affordability, lifestyle, and spacious living, previously hallmarks of Brisbane’s appeal. As prices escalated, homebuyers expanded their search into what were once considered peripheral suburbs, thereby extending the million-dollar club’s boundaries.

- Since the onset of the pandemic in March 2020, Brisbane has witnessed the most robust dwelling value growth on the east coast, with a staggering 58% increase, outpacing Sydney’s 31% and Melbourne’s mere 15% growth.

Migration and Affordability:

- Queensland’s allure, bolstered by its comparative affordability, has drawn nearly 130,000 residents from other states, primarily NSW and Victoria, further fueling Brisbane’s property market.

- Despite its rapid growth, Brisbane’s median house price remained 74% of the national average in December 2023, indicating a narrowing but still present affordability advantage over its southern counterparts.

Looking Ahead:

- However, as Brisbane approaches an affordability ceiling, its meteoric rise in property values is expected to moderate. Yet, the impending infrastructure investments linked to the 2032 Olympics offer a bright outlook for Brisbane’s housing market, potentially ensuring its continued outperformance relative to Sydney and Melbourne.

Navigating Through Recessionary Waters

Finally, let’s examine the current economic climate as Australia grapples with the realities of a per-capita recession. The Reserve Bank of Australia’s recent Statement on Monetary Policy sheds light on the challenges and projections for the nation’s economy, impacting households and the property market alike.

Summary: The Reserve Bank of Australia (RBA) has officially confirmed that Australia is experiencing a per-capita recession. This revelation underscores a period of economic strain characterized by weak household consumption growth amidst rising cost-of-living pressures, high inflation, and increasing interest rates.

Key Findings from the RBA:

- Household Consumption: Remains subdued due to inflationary pressures, heightened tax payments, and climbing interest rates, placing significant stress on household budgets.

- Disposable Income: Real disposable incomes have seen a decline for approximately two years, further exacerbating the financial strain on Australian households.

- GDP Growth Forecast: For 2024, the RBA projects modest real GDP growth of just 1.5%, reflecting the broader economic challenges facing the nation.

- Population Growth: Initially bolstered by net overseas migration, population growth is anticipated to eventually revert to its pre-pandemic average of about 1.5% by 2026, affecting economic growth per capita.

Implications for the Property Market: The per-capita recession indicates that while the overall economy may continue to grow, individual economic well-being could diminish, affecting consumer confidence and spending capacity. This environment poses both challenges and considerations for property investors:

- Affordability Concerns: As household budgets tighten, demand in certain segments of the property market may soften, potentially impacting prices and investment returns.

- Investment Strategies: Investors might need to adapt their strategies, focusing on areas with solid fundamentals that can withstand economic fluctuations.

- Long-Term Outlook: The forecast of a “lost decade” suggests that Australians may face prolonged economic adjustments, emphasising the importance of strategic, long-term investment planning in property.

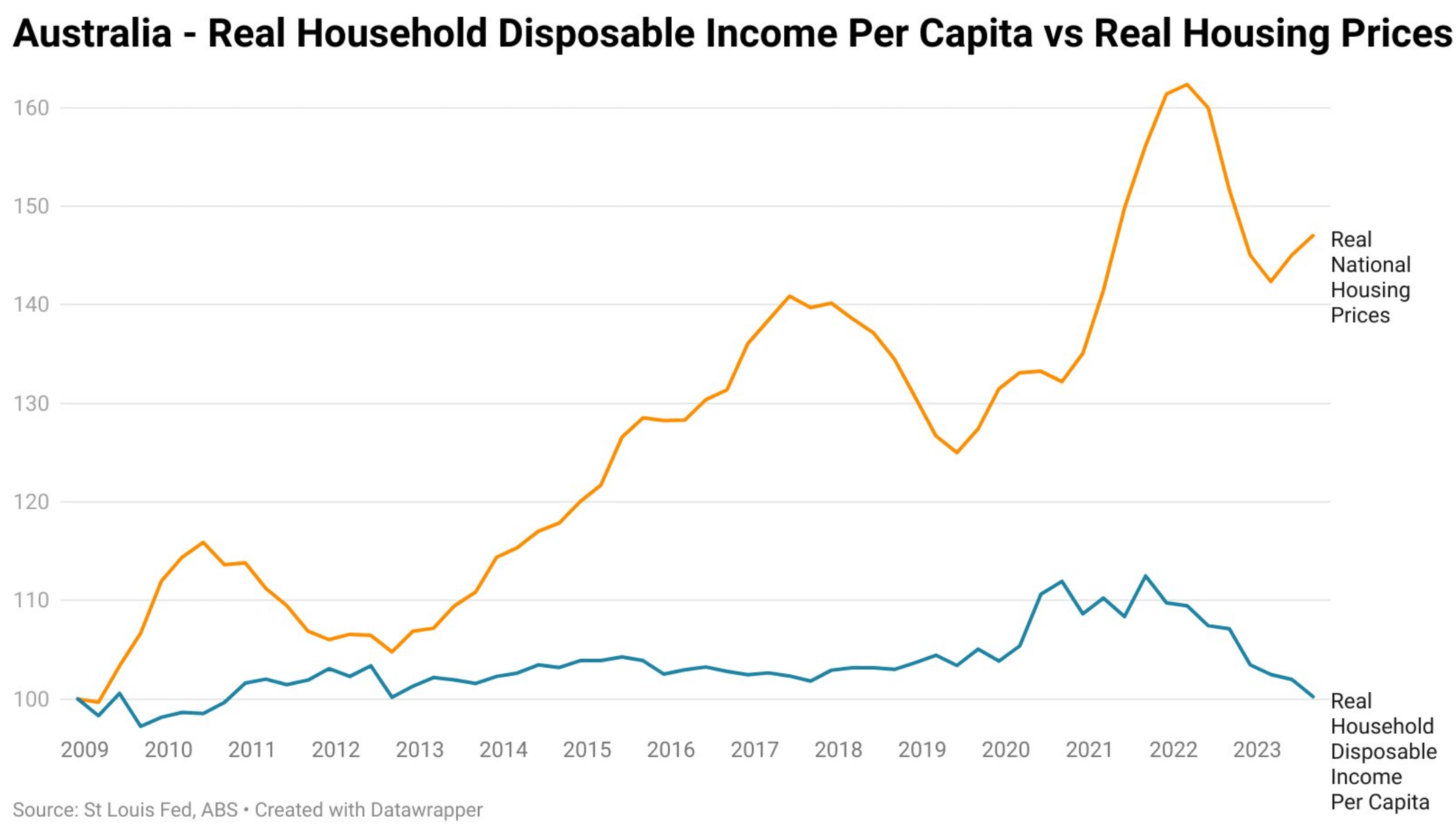

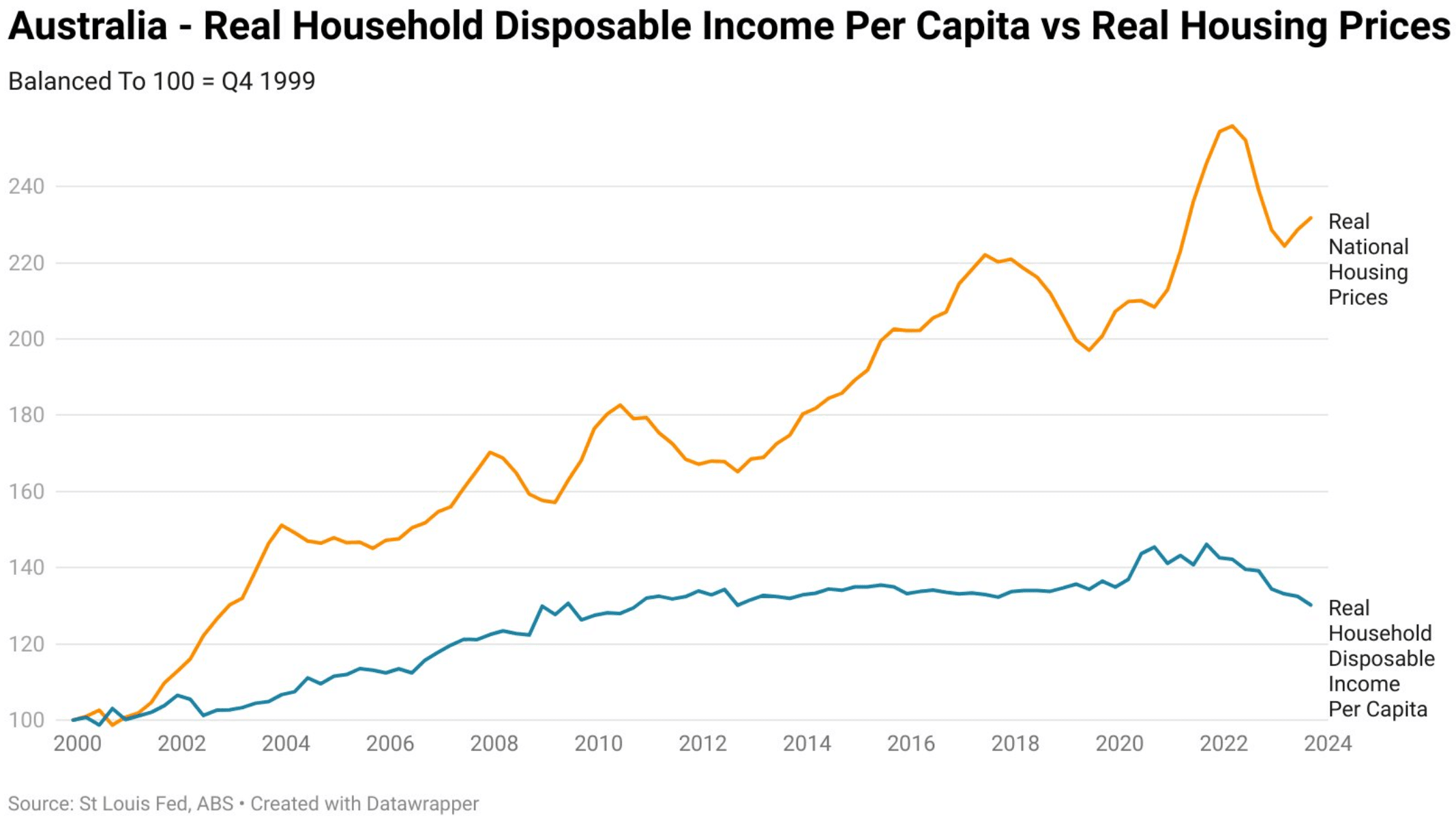

The Housing Market Story

Source: Tarric Brooker

“Since December 2008, real household disposable income has gone basically nowhere”

“Meanwhile, real housing prices have gone to the moon”.

“This is not a recipe for a healthy society” Tarric Brooker.

Source: Tarric Brooker

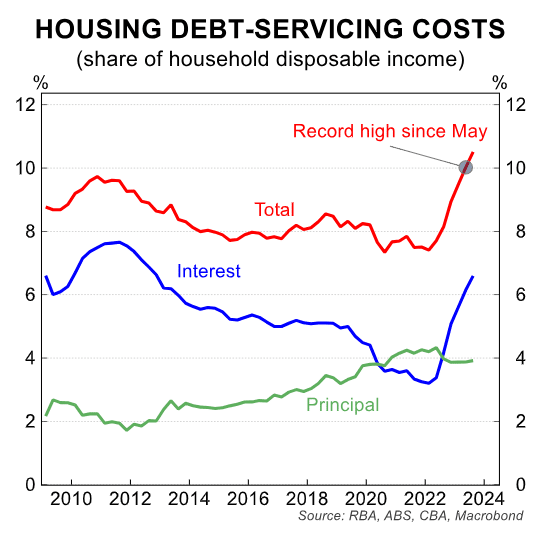

Falling interest rates over a 20 year period to May 2022 (when the RBA first began hiking rates) masked a decline in housing affordability. The 4.25% increase in the official cash rate over the last 2 years has driven home loan servicing to record heights:

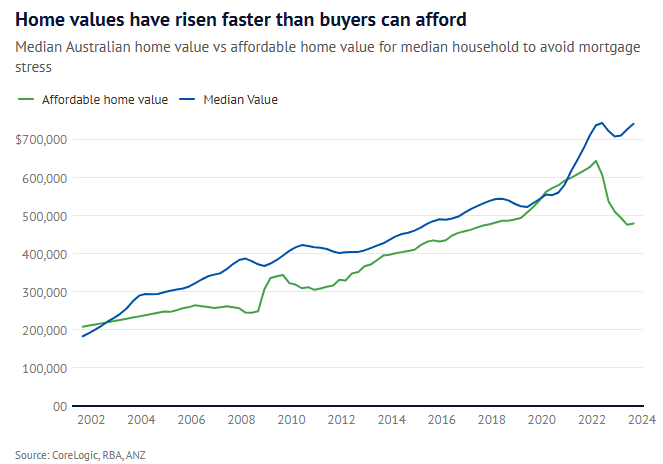

The AFR, recently published the below graph evidencing a record gap between home values and buyer affordability:

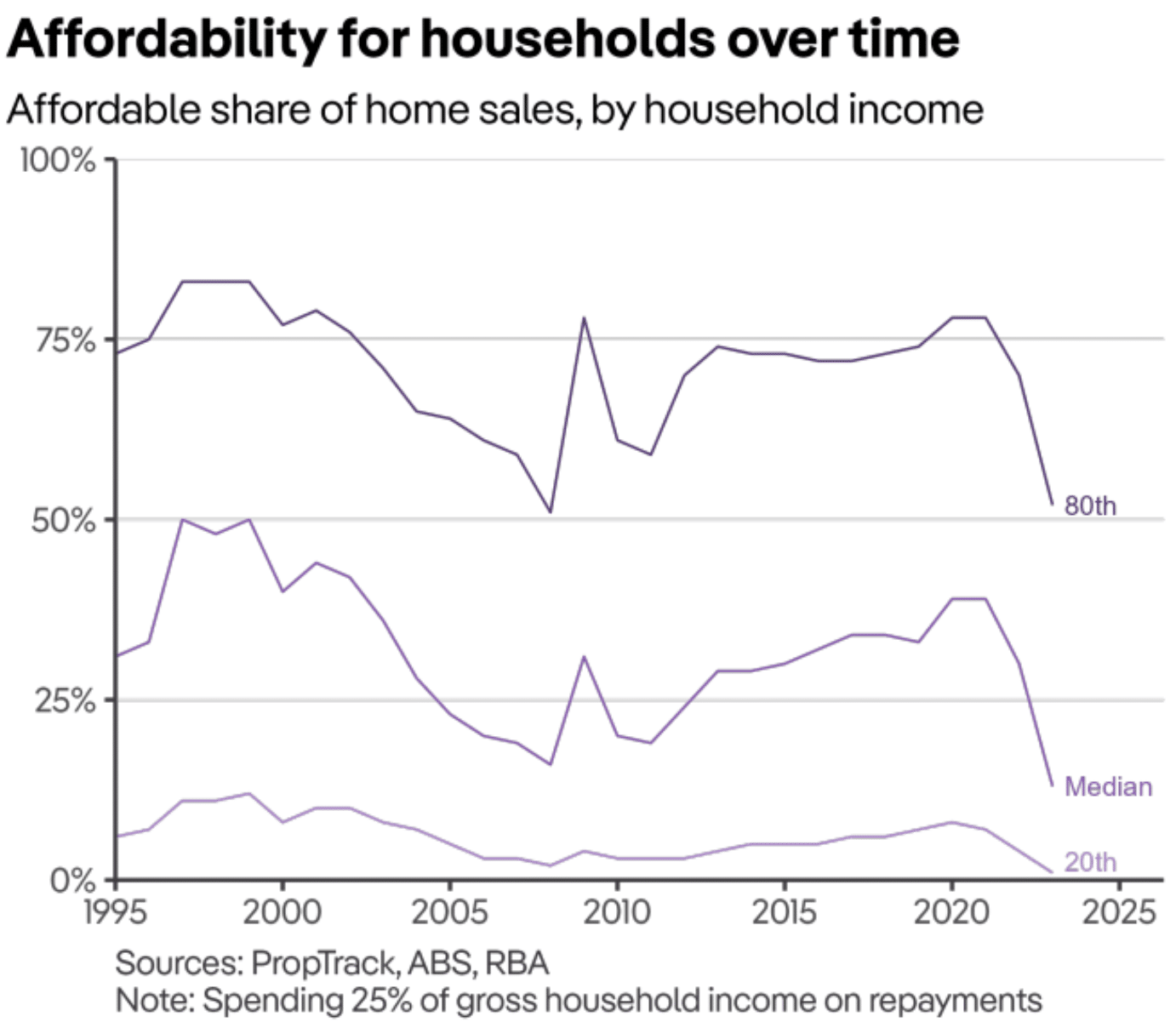

PropTrack data also demonstrates that only 13% of Australian homes are affordable for the average buyer, the worst result in 30 years of data:

Australia’s housing affordability is the worst in history due to a lethal mix of excessively high purchase prices and high interest rates.

Sydney and Melbourne See Surge in Property Listings

In the most recent update from the property market, Sydney and Melbourne have experienced a notable increase in new property listings, with figures from SQM Research highlighting a year-on-year rise of 20.7% and 21.7%, respectively. This surge reflects a growing trend in both cities, further emphasized by a sharp uptick in distressed listings, signalling a potential shift in market dynamics.

Market Insights:

- Distressed Listings: The data reveals a concerning trend, particularly in NSW and Victoria, with distressed listings showing significant annual increases. This suggests a rising number of vendors eager to sell their properties amidst challenging conditions.

- Auction Activity: Despite the increase in distressed listings, the auction market has shown resilience. Last weekend recorded strong auction volumes and clearance rates, with Sydney and Melbourne achieving 70.6% and 67.1% of homes sold, respectively.

- Upcoming Auctions: Auction volumes are expected to climb further, indicating continued market activity. Sydney and Melbourne are preparing for a busy weekend, with auction numbers set to surpass those of the same period last year.

Looking Ahead: Louis Christopher of SQM Research advises caution, noting that while recent auction success rates offer a glimmer of hope, the market remains varied, and the potential impact of economic slowdowns on buyer sentiment should not be underestimated.

As Sydney and Melbourne brace for another busy auction weekend, all eyes will be on whether these strong clearance rates can be sustained amidst rising volumes and the broader economic context, including the Reserve Bank of Australia’s monetary policy decisions.

Closing Thoughts: This Week in Property

This week’s edition of Property Edge has traversed a landscape marked by significant developments in Australia’s property market. From the implications of increased foreign buyer fees and Brisbane’s entry into the million-dollar club to Australia’s economic outlook and the surge in property listings in Sydney and Melbourne, we’ve covered a range of topics that underscore the complexity and dynamism of the real estate sector. The importance of staying informed and agile in one’s investment strategy cannot be overstated. As we look ahead, the resilience of the auction market amidst a rise in distressed listings in Sydney and Melbourne provides a cautiously optimistic note. Yet, the broader economic indicators remind us of the need for prudence and strategic planning.

Property Edge remains committed to delivering the insights and analysis you need to navigate these changing times. Thank you for joining us this week, and we look forward to continuing to provide you with the intelligence and foresight to keep your property investments sharp and informed.

Until next week, stay informed, stay strategic, and stay ahead in the game.

Warmly,

The Property Lovers Team

NEW LIVE IN PERSON PROPERTY WORKSHOP: One of our BIGGEST events this year!

Give us just two days and we will show you how to find and flip properties for cash profits with potentially little to none of your own money from the ‘4d’s’ of real estate investing: distress, deceased estates, downsizers and developers under duress. This isn’t just a workshop, it’s a game-changer with a target of doing 100K deal in next 6 months. We are covering topics that others might shy away from, but we’re about to rip the lid off.

- When: Saturday 2nd March & Sunday 3rd March 2024 (Hyatt Sydney)

- Time: 9:00 am to 5:00pm

You May Also like to Read

Pressing issues affecting homeowners and prospective buyers

Welcome to this week's edition of the Property Edge newsletter. As we navigate the ever-evolving landscape of Australia’s...

Why Australia Will Never Build Enough Homes

Welcome to this week's edition of the Property Edge newsletter. As we navigate through a rapidly evolving property...

Unlocking Potential: Uncovering Hidden Gems in Australia’s Property Market

Welcome to this edition of Property Edge, where we delve into the latest trends and insights shaping the Australian property...

Suburbs on the Rise: Property Searches Indicate Growth Potential

Welcome to the latest edition of Property Edge, where we delve into the dynamic world of real estate. In this issue, we...

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week's edition of Property Edge, where we delve into the current state of the property market through the...

Foreign Investment In Australia’s Residential Real Estate Is On The Rise

Welcome to this week's edition of Property Edge, where we delve into the latest trends and developments in the Australian...