Forecasts From Economists and Major Banks Offer Different Perspectives as to What’s in Store in 2024

Published 11:51 am 5 Jan 2024

Let’s dive into the week’s property news with our concise roundup. We’ve got you covered with key insights and expert forecasts to keep you ahead in the ever-changing Australian real estate market. Let’s explore the highlights!

SMH

A Sydney Morning Herald article yesterday offered a comprehensive overview of the varying expert opinions on the property market trends expected in Australia for 2024. Despite a slowdown in property price growth, experts are divided on how much further prices will climb. Some predict subdued gains, while others warn of a potential downturn. The numbers are in and it’s now official – In 2023, property prices in Australia rebounded against expectations, with an 8.1% increase from January’s low, driven by low supply and a housing shortage.

The various forecasts from economists and major banks offer different perspectives as to what’s in store in 2024. Gareth Aird of the Commonwealth Bank anticipates a 5% increase in capital city prices, with a slower growth rate due to high interest rates. ANZ’s Adelaide Timbrell predicts an average rise of 6%, with Brisbane possibly seeing up to 10%. The National Australia Bank (NAB) expects an average increase of 5.4%, while Westpac forecasts a 6% growth, with Perth predicted to lead at 10%.

Key factors influencing these forecasts include higher interest rates, housing supply challenges, interstate migration, and international immigration trends. Despite these optimistic projections, Dr. Shane Oliver from AMP predicts a 5% decline in prices across capital cities, citing affordability issues and a potential rise in distressed listings.

News.com.au

A News.com.au article this week delved deeper into the specific city-wise property forecasts for the year and highlighted the unexpected resilience and growth of the Australian housing market in 2023 and the forecasts for 2024.

PropTrack anticipates a national increase of 1% to 4%, with Perth, Adelaide, and Brisbane expected to record the strongest gains. These predictions consider factors like ongoing strong demand, limited new housing construction, and interest rate trajectories.

Westpac and ANZ expect specific cities like Perth and Brisbane to perform strongly. Factors such as Australia’s population growth, the hot rental market, and foreign buyer activity are said to be contributing to this upward pressure on home prices.

Additionally, the luxury apartment market is expected to boom, driven by changing preferences for larger, higher-quality apartments and a growing population. The environmental aspect is also influencing buyer demand, with a shift towards greener homes.

However, CoreLogic warns of a more subdued market in 2024 due to factors like rising unemployment, slowing GDP growth, and stretched household budgets. This outlook suggests a complex and dynamic year ahead for the Australian property market.

REA

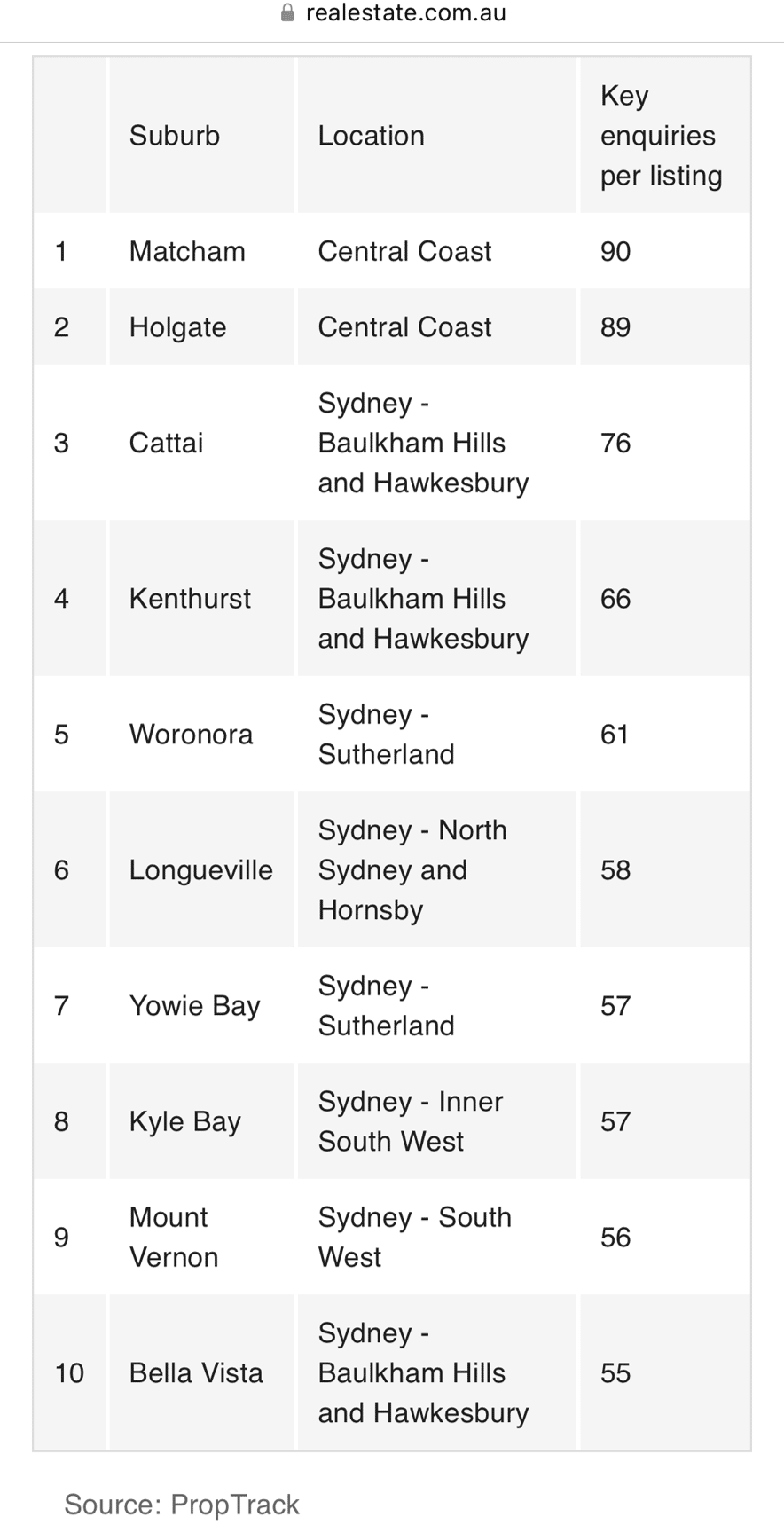

Shifting our focus from the broader Australian property market trends to specific locales, let’s dive into the most sought-after suburbs across the country. As detailed in Henry Johnstone’s insightful article written for REA, the allure of semi-rural living and lifestyle-centric locations has significantly shaped buyer preferences in 2023. Let’s unveil these coveted areas, revealing where Australians are aspiring to live in the quest for more space, tranquility, and quality of life.

According to PropTrack data, buyers are increasingly seeking semi-rural suburban areas for a better lifestyle, with some areas receiving almost 100 key enquiries per listing. These enquiries include high-intent activities like contacting agents or requesting inspections.

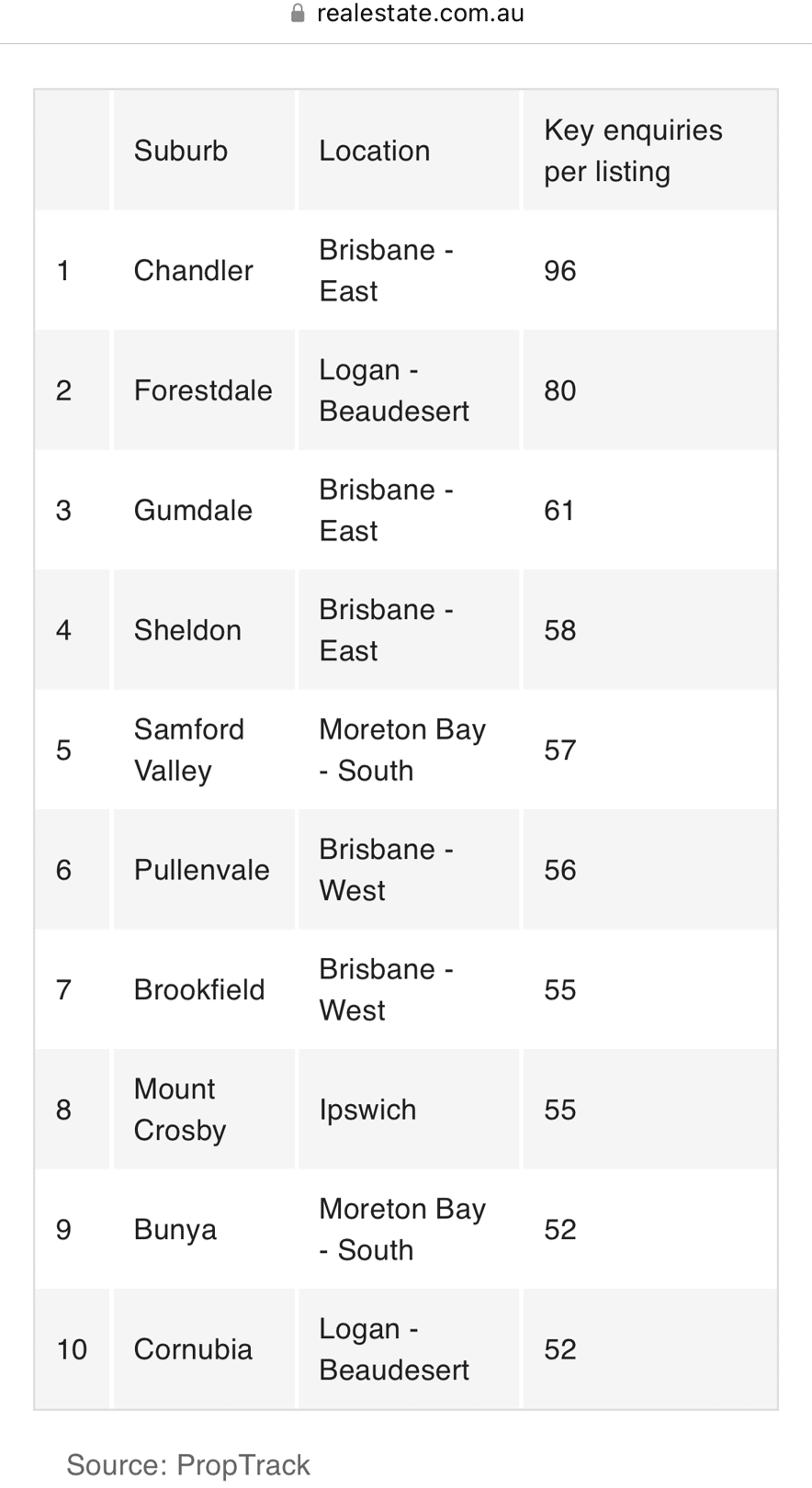

The article emphasises the appeal of “lifestyle regions” in cities and their outskirts, a trend that has persisted post-pandemic. Brisbane’s eastern and southern regions house some of the country’s most sought-after suburbs. Despite significant price growth since the pandemic, these areas still offer relative affordability, especially when compared to states like Victoria.

The top in-demand suburbs nationally in 2023 include Chandler in Brisbane, Matcham and Holgate on the NSW Central Coast, and Forestdale in Queensland’s Logan-Beaudesert. These areas are characterised by large blocks and homes, appealing to those looking to upgrade, benefiting from pandemic price growth.

Chandler, with an average of 96 key enquiries per listing, is particularly noted for its tight-knit community and appeal to a diverse range of buyers, from country farmers to inner-city locals. The Central Coast’s popularity is attributed to lifestyle demand and affordability pressures pushing people away from Sydney.

Additionally, the north-western suburbs of Greater Sydney, like Cattai and Kenthurst, are also highly in demand. Woronora in Sydney’s Sutherland Shire stands out for its affordability, especially for waterfront properties.

The top 10 most in-demand regional areas in Australia, apart from Newrybar in NSW’s Northern Rivers, are dominated by suburbs on Queensland’s Gold Coast and Sunshine Coast. Kingsholme on the Gold Coast, Tallebudgera Valley, and Sunshine Coast suburbs like Verrierdale and Yandina Creek are highly sought after, reflecting the continued appeal of these regions post-pandemic.

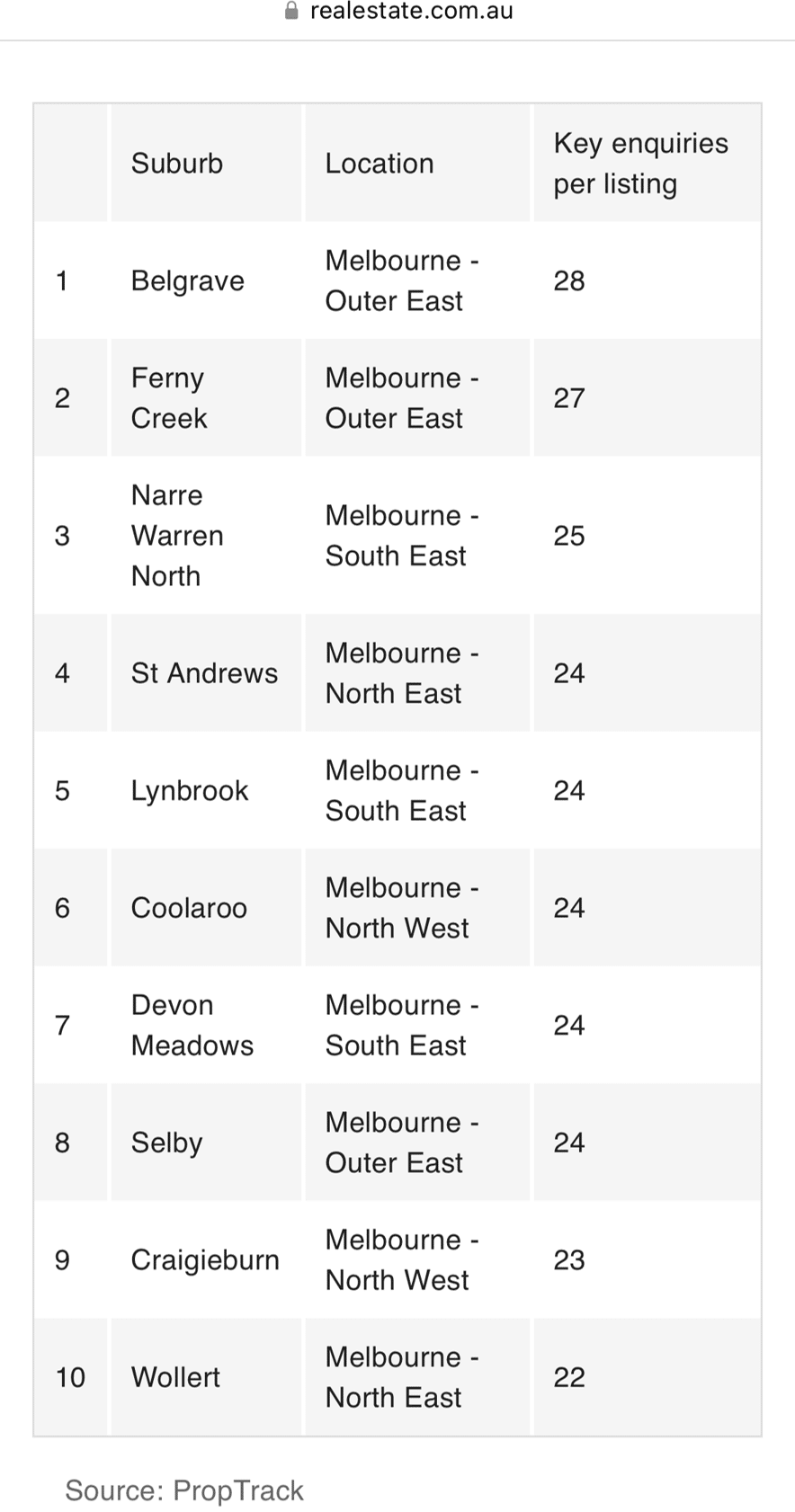

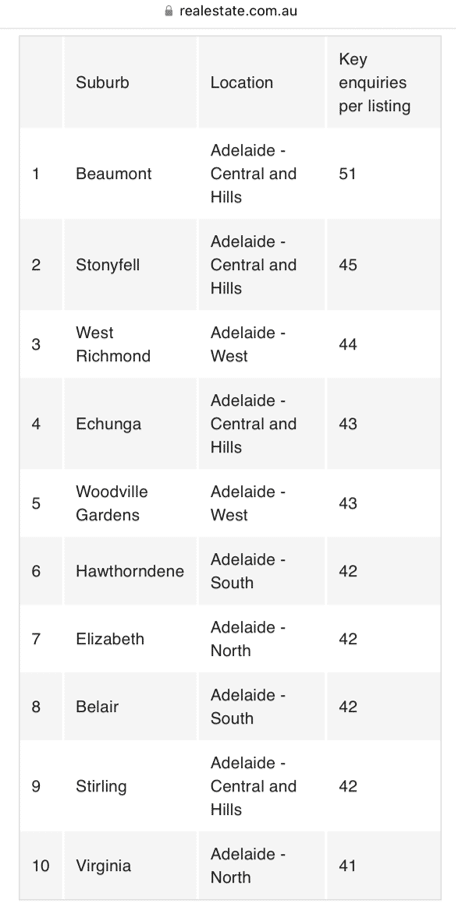

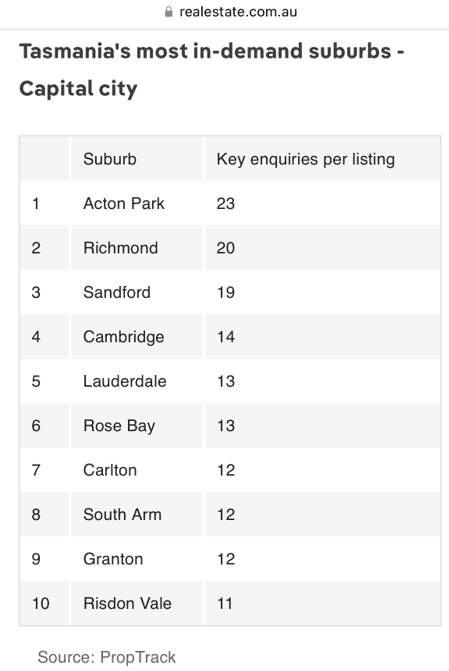

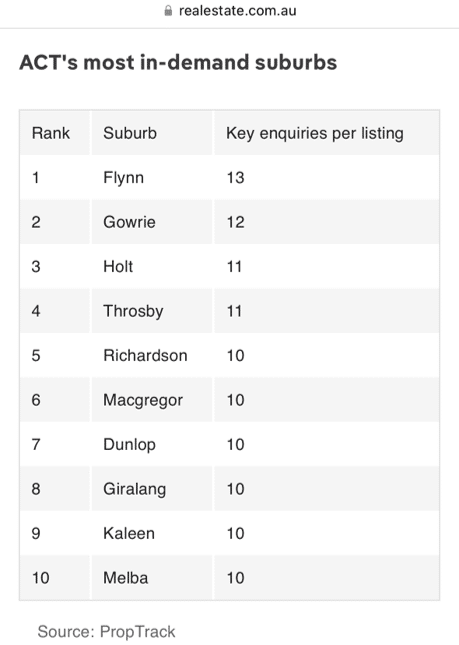

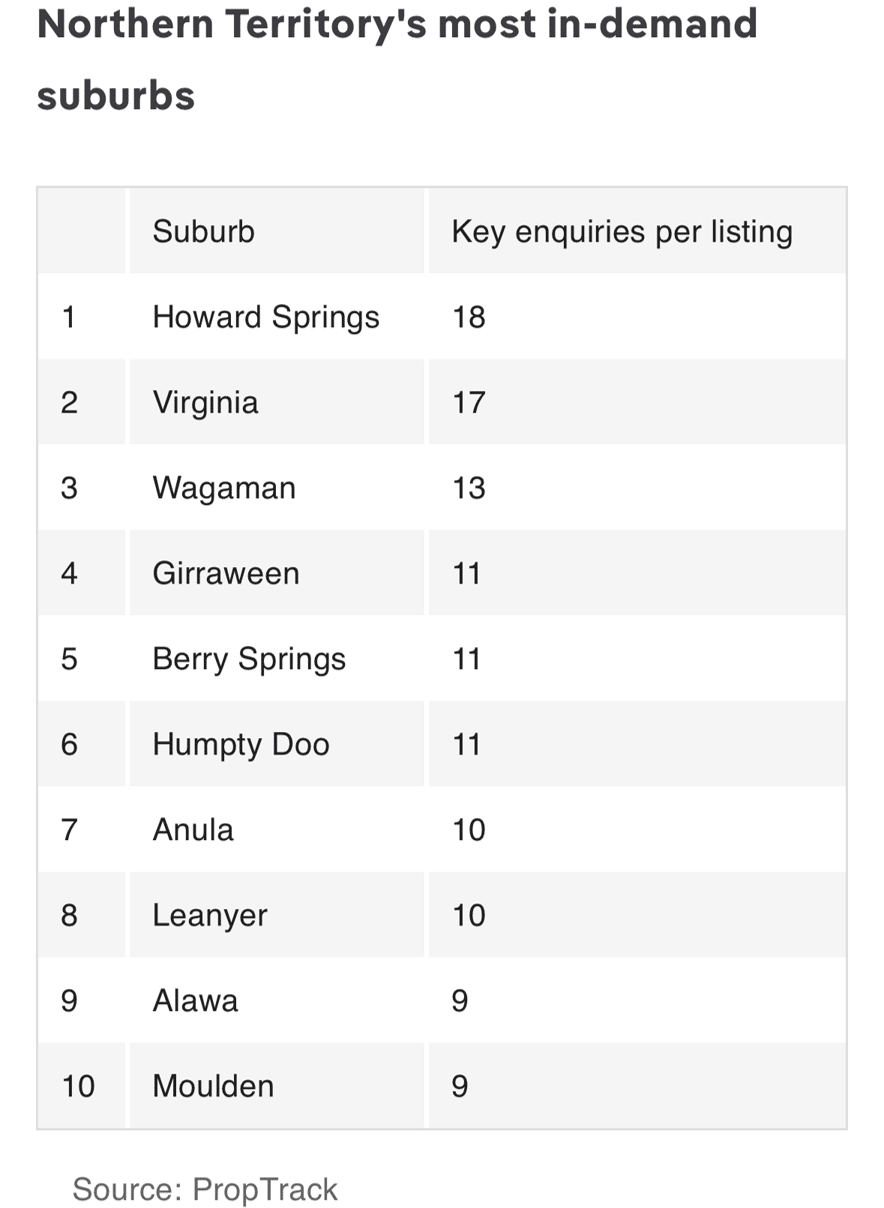

Here are the top 10 most in demand suburbs in each state along with the number of enquiries per listing: (Source: realestate.com.au)

NSW Most in demand suburbs – Capital City

Victoria most in demand Suburbs- Capital City

Queensland Most in Demand Suburbs: capital City

WA Most In Demand Suburbs: capital city

SA most in demand suburbs: capital city

Tasmania Most in demand Suburbs

ACT Most In Demand Suburbs

Northern Territory’s Most In Demand Suburbs.

Adding to our property market overview, Madeleine Achenza’s piece from news.com.au introduced insights from three experts, offering a fresh angle on house prices, rentals, and investments for 2024. This article rounds out our week’s property news, giving us a broader picture of the challenges and opportunities ahead. Here are the main points to note:

Experts’ Overview:

- Nerida Conisbee from Ray White, Kent Lardner from suburbtrends.com.au, and Cameron Kusher from PropTrack offered their insights in the wake of six rate rises in 2023 and the likely economic outlook for 2024.

Property Price Predictions:

- Lardner finds predicting property prices challenging, noting some regions are recovering from pandemic downturns.

- Conisbee predicts continued price growth due to low housing supply and high rental demand.

- Kusher expects price rises but at a slower rate, influenced by construction costs and housing supply issues.

Regional Market Insights:

- Brisbane and Perth are seen as areas with affordability and investment opportunities.

- There is notable affordability in Perth, with a median house price of 520K.

Mortgage Cliff and Financial Strain:

- The anticipated ‘mortgage cliff’ hasn’t had as severe an impact as expected.

- Financial stress is evident, particularly in outer suburbs with high concentrations of new mortgages.

Shifts in Regional and Coastal Living:

- The pandemic-driven trend towards regional living is reversing bringing with it price corrections in some beachside and holiday destinations.

- Commutable regional locations may retain their value.

Investment Market Dynamics:

- Investors are seeing challenging conditions due to high interest rates and tighter credit regulations.

Rental Market Pressures:

- Renters face high costs with little relief in sight.

- The high percentage of income spent on rent is a concern.

The article paints a picture of a property market in flux, grappling with the aftermath of the pandemic, economic pressures, and shifting preferences in living and investment.

And that’s a wrap for this week’s roundup! As we continue to navigate a diverse landscape of expert analyses and predictions. From the cautious optimism in property value trends to the complexities of regional market dynamics, we’re here to cover off on the high notes (and inevitable lows) of an ever-evolving real estate sector in Australia. Stay tuned as we continue to bring you the latest insights and updates, helping you stay informed in this dynamic market. Until next week’s roundup, here’s to making informed decisions in the world of real estate.

PS: NEW WEBINAR ALERT: Want to know how our students are profiting to the tune of multiple 6 figures right now acquiring undervalued distressed properties without finance, any of their own money or even without paying stamp duty or CGT?

At this timely Distressed Property Masterclass, we’ll show you how this is possible.

Register now for FREE! Click here to register.

You May Also like to Read

Pressing issues affecting homeowners and prospective buyers

Welcome to this week's edition of the Property Edge newsletter. As we navigate the ever-evolving landscape of Australia’s...

Why Australia Will Never Build Enough Homes

Welcome to this week's edition of the Property Edge newsletter. As we navigate through a rapidly evolving property...

Unlocking Potential: Uncovering Hidden Gems in Australia’s Property Market

Welcome to this edition of Property Edge, where we delve into the latest trends and insights shaping the Australian property...

Suburbs on the Rise: Property Searches Indicate Growth Potential

Welcome to the latest edition of Property Edge, where we delve into the dynamic world of real estate. In this issue, we...

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week's edition of Property Edge, where we delve into the current state of the property market through the...

Foreign Investment In Australia’s Residential Real Estate Is On The Rise

Welcome to this week's edition of Property Edge, where we delve into the latest trends and developments in the Australian...