RBA Hints at a Property Market Intervention

Published 5:29 am 24 Sep 2021

Will the RBA pull the plug on the piping-hot property market?

In the closing statements of the ‘Housing Market and Financial Stability’ speech delivered by the RBA’s Assistant Governor Michele Bullock on Wednesday, Bullock hinted at the possibility that the RBA could intervene in Australia’s housing market.

Bullock stated that Australia’s runaway housing price growth poses a threat to the financial stability of the economy, given the growing amount of household debt being taken out in order to purchase property.

“A high level of debt could pose risks to the economy in the event of a shock to household incomes or a sharp decline in housing prices. It is these macro-financial risks that warrant close watching. Whether or not there is a need to consider macro-prudential tools to address these risks is something we are continually assessing.”

It’s unclear precisely what macro-prudential tools the Reserve Bank is considering, however increasing the current interest rates won’t be part of the plan, said RBA Governor Philip Lowe last week.

“While it is true that higher interest rates would, all else equal, see lower housing prices, they would also mean fewer jobs and lower wages growth. This is a poor trade-off in the current circumstances,” said Lowe.

Discover how to find and secure properties at up to 40% below market value

According to CoreLogic, the macro-prudential tools used by the RBA may include “higher serviceability assessments for borrowers – essentially raising the minimum interest rate used when assessing whether a borrower can service their loan, or portfolio level restrictions could be imposed on lenders, probably focussed on establishing firm benchmarks on the proportion of high debt-to-income ratio loans that can be issued.”

The CBA chief executive Matt Comyn has echoed the RBA’s sentiments and similarly believes there may be a necessity to intervene in the housing market:

“It would be important to take some modest steps sooner rather than later to take some of the heat out of the housing market.”

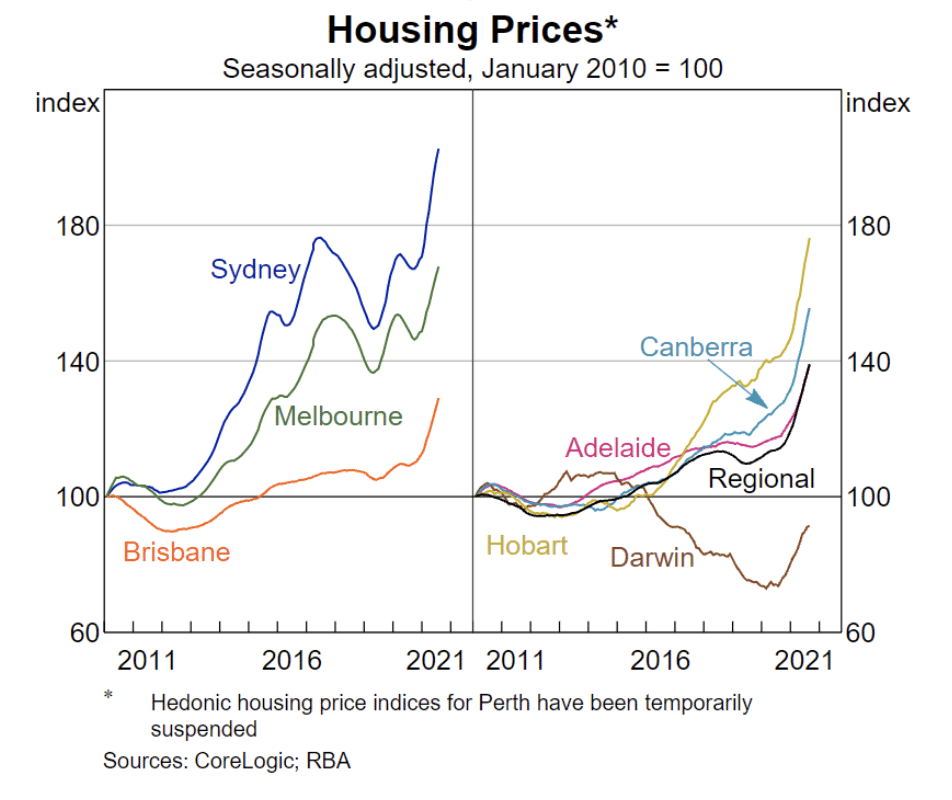

The need for macro-prudential intervention as highlighted by the RBA and CBA comes at a time when Australian house prices are growing at their fastest annual pace since 1989, a rate which is almost 11 times faster than wages growth over the past year.

Moreover, in just the first half of the year, $1 trillion was added to household balance sheets after property owners enjoyed the fastest growth to their personal wealth in over a decade.

This creates a risk according to Bullock, primarily for “Households that have borrowed a lot to purchase a home relative to their income [that] could, in the event of a shock to their employment status or income, find they are unable to continue to service their loans.”

Businesses and workers are struggling

Bullock’s fears – that changes in employment status may lead to an inability to repay home loans – aren’t unfounded either.

According to a recent YouGov poll, the biggest fear held by Australians is losing their jobs; and rightly so. Australia’s participation rate dropped from 66 to 65.2 per cent in August, with 211,188 fewer people in the labour force than in the June survey.

“Beyond people losing their jobs, we have seen unemployed people drop out of the labour force, given how difficult it is to actively look for work and be available for work during lockdowns,” explained Bjorn Jarvis, the head of labour statistics at the ABS.

Lockdowns have placed immense pressure onto many industries, with retail juggernauts like Kikki.K unable to escape the financial hardship. Last week, Kikki.K announced that it would be going into voluntary administration.

“The loss of revenue from the forced and extended closure of so many of our stores due to the Covid pandemic as part of the government ordered lockdowns has taken a direct massive and insurmountable toll,” said the company’s founders, adding that “It has simply not been possible to get through such a seismic event outside of our control.”

Kikki.K’s precarious position has put 300 Australian jobs in jeopardy, and there are many other businesses in similar positions.

Is the Australian dream becoming a nightmare?

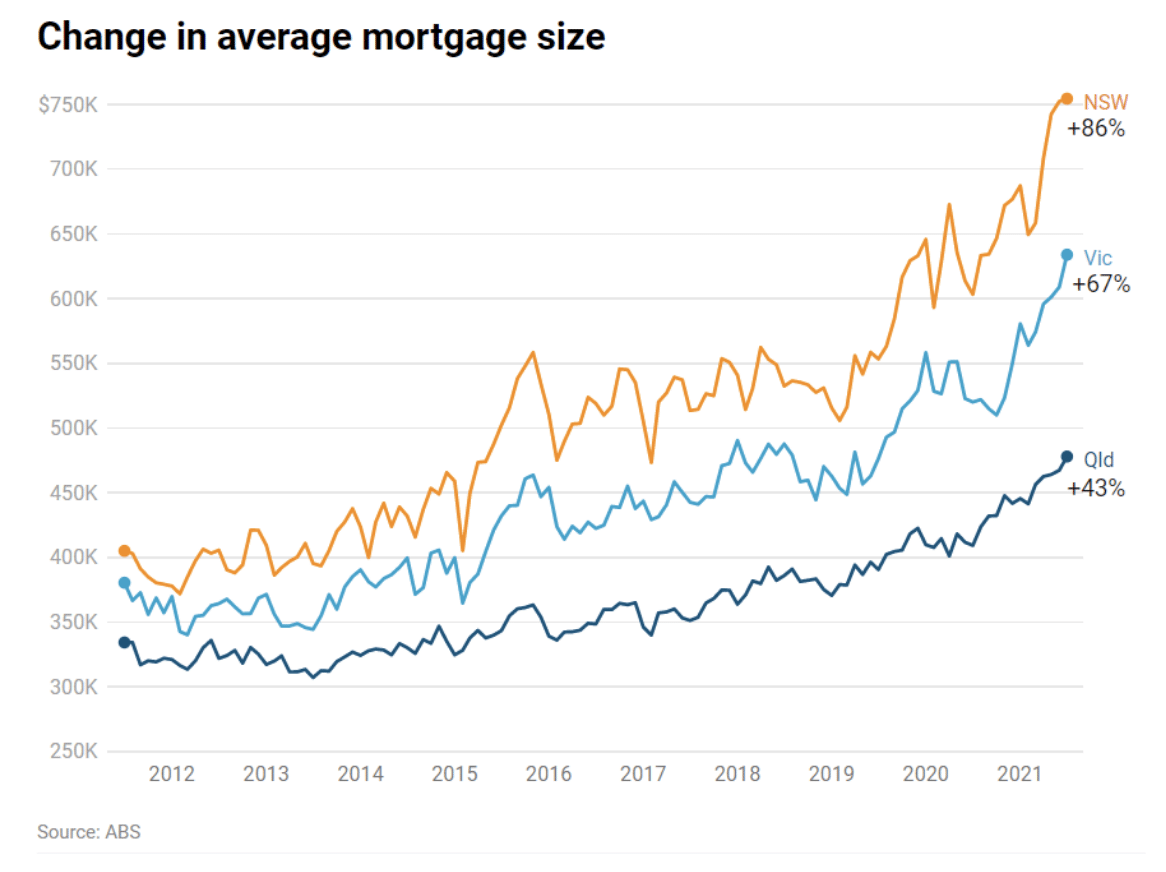

In addition to businesses and employees facing some of the most precarious employment conditions seen in decades, many Australians have overextended themselves in order to get into the bustling property market amid record low interest rates.

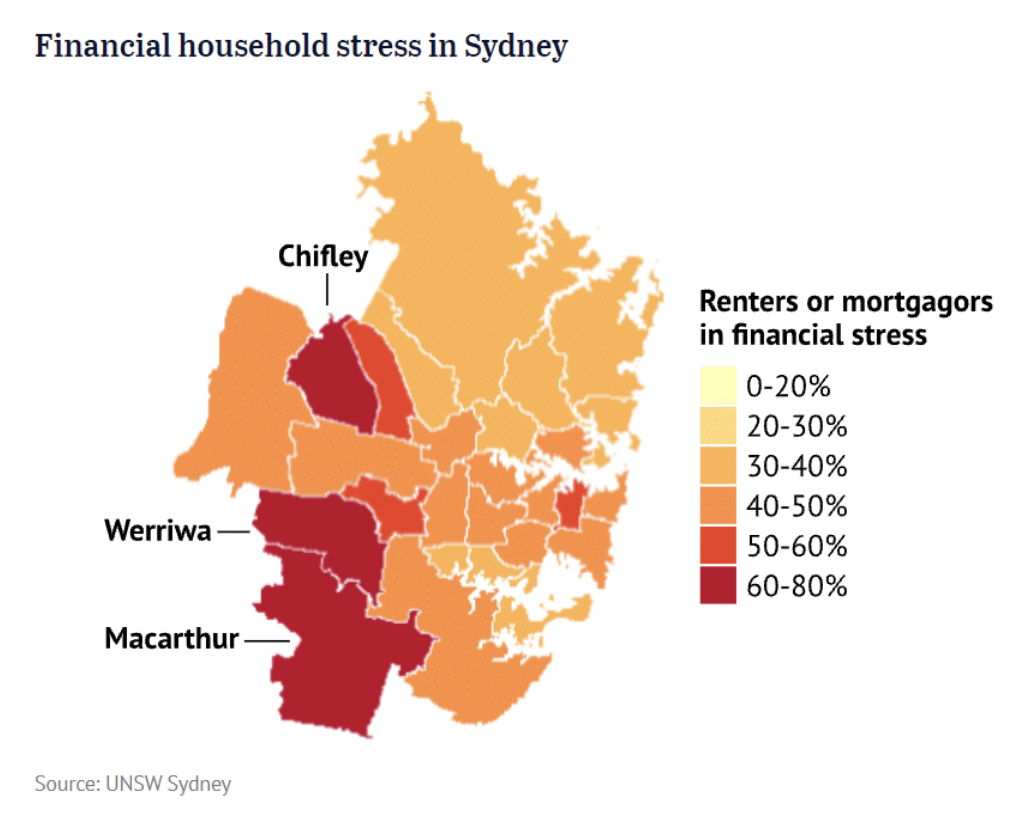

A study by UNSW which analyzed 52,000 households found that nearly 42 per cent were facing mortgage stress, up from roughly 33 per cent in February last year.

Mortgage stress has been most heavily felt in Sydney and Melbourne where prices have seen the largest increases. Sydney’s median house price has risen by $308,000 this year up to $1.3 million, and Melbourne’s median house price has reached $955,000, up $173,000 over the past 12 months.

Alongside these property value increases, so too have mortgage costs risen. The average mortgage to buy a house in Victoria has climbed 33 per cent over the past two years up to a record $634,000 in July, and in New South Wales, the average mortgage climbed by 36 per cent to $755,000.

According to the study, the highest rate of mortgage stress was in the outer-Sydney electorate of Werriwa with nearly 71 per cent of people struggling with their home loan. Additionally, electorates such as Greenway, La Trobe and McEwen all have a roughly 60-70 per cent rate of respondents struggling with their home loans.

If you are one of the many Australians struggling with mortgage debt, let our caring and compassionate Debt Management team help you to assess your current financial situation and create a customised plan for you to help get your life back on track.

And, not only are many mortgage owners becoming saddled with more debt than they can handle, the UNSW study found that those with investment properties were also struggling, with 51.4 per cent of households in MacNamara in Melbourne struggling to repay their investment loans and 57.5 per cent of households in Sydney struggling to do the same.

And, with mortgage stress increasing across the country, requests for home loan deferrals have also continued to spike, according to recent data from the Australian Banking Association (ABA).

The ABA data shows that home loan deferrals made by customers of the big four banks have jumped 86 per cent to more than 27,000 in the last month alone. The ABA report also mentions that in February last year, just under a third of households were struggling with their finances. Now, that number has risen to 41.7 per cent.

Homeowners in need

As CoreLogic identified in their analysis on ‘The impact of macro-prudential policies on the housing market,’ a tightening of credit conditions would “flow through to less home purchasing activity and add to the headwinds of worsening housing affordability.”

Though ultimately, any action by the RBA at this point will do very little to help homeowners and property investors who are heavily overexposed amid a precarious labour market.

This means that many Australian homeowners have their backs against the wall, with few attractive paths forward.

However, this also means there is a huge opportunity to secure properties at below market value while also helping homeowners who have fallen on hard times by giving them options they may otherwise not know are available to them.

That’s why we’d like to invite you to the Real Estate Rescue Masterclass with Dominique Grubisa, where you’ll discover:

How to find and secure properties at up to 40% below market value before the bank moves in

You May Also like to Read

Unlocking Potential: Uncovering Hidden Gems in Australia’s Property Market

Welcome to this edition of Property Edge, where we delve into the latest trends and insights shaping the Australian property...

Suburbs on the Rise: Property Searches Indicate Growth Potential

Welcome to the latest edition of Property Edge, where we delve into the dynamic world of real estate. In this issue, we...

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week's edition of Property Edge, where we delve into the current state of the property market through the...

Foreign Investment In Australia’s Residential Real Estate Is On The Rise

Welcome to this week's edition of Property Edge, where we delve into the latest trends and developments in the Australian...

How Far Australian House Prices Have Soared Above Fair Value

Welcome to the latest edition of Property Edge, your definitive source for insights into Australia's dynamic real estate...

February Home Price Movements Across Australia

Welcome to another edition of Property Edge, your definitive source for insights into the Australian property market. This...