5

DAYS

![]() No credit card required

No credit card required

5

DAYS

10

HOURS

54

MINUTES

40

SECONDS

We are Navigating Uncertain Economic Waters and You Need to Be Proactive, Take Control and Have Your House In Order. One wrong step could see you lose everything.

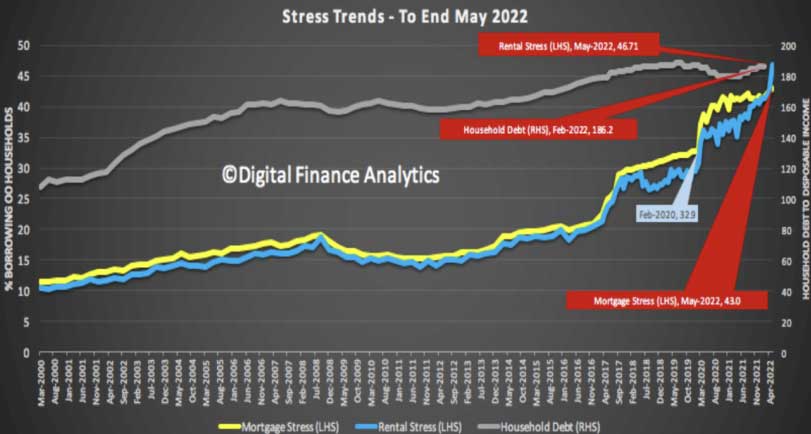

We know interest rates have a lot further to rise and house prices (where we store most of our wealth) are falling. As we enter one of the coldest winters in history, energy prices are soaring, inflation is out of control and wages are not going up. Consumer confidence has fallen for the sixth month in a row.

There are some massive headwinds coming our way and there will be a day of reckoning where a lot of people lose a lot of their wealth.

Debt is like a game of musical chairs and you want to make sure you’re not the last man standing.

Most people know that there is trouble brewing but they don’t know what they don’t know and their strategy is to cross their fingers, hope they make it in the dash for a chair when the music stops and that they come through the bumpy times ahead with as much as they had going in.

But hope is not a strategy!

Many factors are now converging that are a “first time” experience for most people. The 6 known knowns or indisputable objective facts are as follows:

However, as Charles Darwin said, in times of change it is not the strongest or the smartest who survive and thrive, it is those who are the most responsive to change.

For a select few, it will be a case of not just surviving but thriving. They will be in control of their assets and wealth no matter what lies ahead because they took action to protect everything now and set themselves up for opportunities ahead.

That’s why we are holding a special one-off emergency masterclass to empower you to take control of what’s yours to lose right now as everything changes.

Take Control of What’s Yours to Lose Right Now as Everything Changes.

In this Masterclass you will learn:

And much more …..

Quarantine your home from banks, creditors and litigators, even if you owe money.

Grow your business while protecting your profits and income.

Safeguard your bank accounts while increasing your wealth.

Safeguard your rental income and properties while expanding your portfolio.

Shield your wages from garnishees and installment orders.

Safeguard your retirement nest egg from meltdowns and nationalization.

Advice Warning: All content and information provided in this webpage and at the event is general advice and for educational purposes only. None of the information contained within this webpage or at the event constitutes, or is intended to constitute, a recommendation by the presenter that any particular security, investment or strategy is suitable for any specific person. None of the information contained in the webpage is, or is intended to be, personalised investment advice. Investments or strategies mentioned in the webpage may not be suitable for all individuals. All readers of the webpage should make their own independent decision regarding them. The material contained in the webpage does not take into account each reader’s particular investment objectives, financial situation or needs. All readers should strongly consider seeking advice from their own personal investment adviser based on their specific circumstances. Past performance is not indicative of future results.

In the event of a student sharing their story, no remuneration was offered or paid to the student for sharing their story. The timeline and details of all student transactions have not been verified by Dominique Grubisa. If you wish to make a particular investment or follow a particular strategy then you should consult a financial adviser to fully understand the risks associated with that course of action in your particular circumstances.

DG Institute Pty Ltd may refuse registration or entry to any individual. This event is not suitable for young children or babies and entry may be refused. Recording devices of any kind, animals and illegal substances are strictly prohibited. The event may not be recorded or photographs taken without the express permission of DG Institute Pty Ltd. In addition, no flyers, advertising or marketing collateral may be distributed at the event.

Your attendance shall constitute your acceptance that during the event, each speaker will be offering additional courses for purchase by participants. These courses will enable you to learn in greater detail how to put into practice the speaker’s strategies. These additional educational services will be offered for sale at the event. You are free to choose whether or not you want more information or wish to purchase the further services offered by the speaker.