How to Find Great Deals in Australia’s Booming Property Market

Published 3:33 am 9 Jul 2021

Australia’s property market is running hot, but with property values at record highs, how can investors find a good deal?

The combined value of Australia’s housing market now sits at $8.4 trillion as of June 2021, as record-low interest rates and favourable lending conditions have helped to fuel the property market.

Property loans have increased over 25% over the past 12 months totalling $274.6 billion, and residential property prices have risen a whopping 13.5 per cent over the 2020/21 financial year, a growth rate not seen since 2004. With such a hot market, many property investors are reaping huge rewards.

→ Discover The Property Hot Spots In Australia Right Now

Though as hundreds of suburbs enter the million-dollar club each month, finding an attractive property to invest in is becoming increasingly difficult without breaking the bank.

However, don’t be discouraged, there are still key indicators you can keep an eye on within Australia’s property market to ensure you’re purchasing in a high-growth area.

Don’t Over Borrow

As a property investor, your number one goal will be to generate profits.

With increases to property values Australia-wide, brought on by low-interest rates, relaxed lending laws and other favourable conditions, it can be difficult to find undervalued properties in this current state of the market.

Additionally, these relaxed lending conditions also place the onus on those in the property market to not over-extend their borrowing capacity, and many Australians are already biting off more than they can chew with regard to their repayments.

Overwhelming yourself with debt to getting into the property market is a risky decision, and when interest rates inevitably rise, it may place many into a precarious financial position.

This is why it’s important to find the best deal for you, ensuring that you weigh up your options and find the right indicators to look out for when deciding on your next investment property.

Here are some indicators that will help you find great deals in this booming market.

Supply and demand of Property

Naturally, as the demand for property in a particular area exceeds supply, there will be upward pressure on the price of properties in that area.

In order to get an idea of the supply and demand of a particular area, there are various indicators you can look at:

- Sales volume

- Population growth

- Population overview

- Average property price

- Auction clearance rates

- Average time on market

- Property development approvals

Each of the above indicators will help you to determine the supply and demand of properties in your desired area and can inform you about whether that area has healthy trends surrounding it.

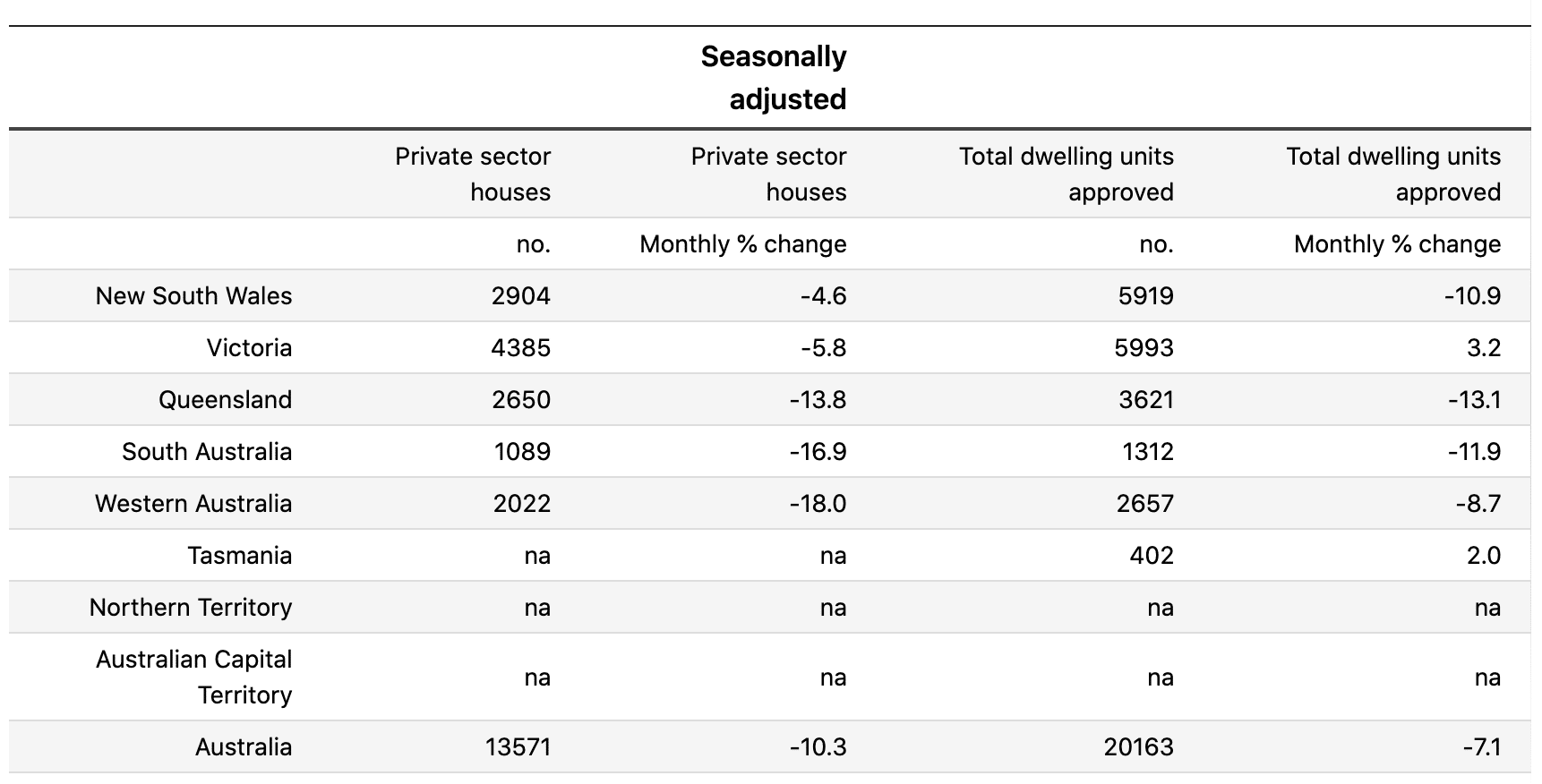

Dwellings approved, states and territories

Source: ABS building approvals, Australia

One of the most powerful indicators of the trajectory of a suburb’s property values is population growth, as increases to the population of an area will increase demand for property while reducing the supply.

Historically, most of Australia’s population growth has been driven by overseas migration. However, this has effectively stopped during COVID-19, and virtually all population growth in the country is now being driven primarily by domestic migration.

During the pandemic, domestic migration has risen to a level not seen since the ABS began measuring it in 2001, and according to the ABS “Queensland gained the most people from net interstate migration (+9,800) over the December 2020 quarter, while Victoria lost the most (-6,500).”

As such, while international travel remains reduced, domestic migration patterns may be a useful metric to examine when determining if an area is undervalued.

While domestic migration will likely change once vaccination rates increase and global migration patterns return to some level of normalcy, it’s also likely that workplaces will continue to allow for working from home, and cities could continue to see a sustained reduction in their population growth.

Vacancy Rates & Rental Returns

In addition to looking at the supply and demand of property in your desired area, you’ll also want to look at vacancy rates if you plan on leasing out your property.

When an area has low vacancy rates it means that fewer properties are available for rent on the market and there is less rental competition. When the supply for rental properties is lower, you are able to generate a higher rental income. In addition to yielding higher returns, choosing an area with low vacancy rates can also reduce the time on market that you are without rental income.

Given that rental yields are determined by supply and demand, you’ll want to see how much development is planned for that area over the coming 24 months, as that may impact the supply of rental properties, and thus lower your potential rental yield. You can speak with the local council where you wish to purchase property to find out how many development applications have been lodged.

|

Capital Cities (houses & units) – May 2021 |

|||||

| State | Median Price | Median Price | Vacancy Rate Average | Rental Yields (Houses) Q1 | Rental Yields (Units) |

| NSW (Sydney) | $950,457 | $771,859 | 2.90% | 2.4% | 3.5% |

| VIC (Melbourne) | $744,679 | $599,234 | 3.70% | 2.6% | 3.3% |

| QLD (Brisbane) | $558,295 | $405,902 | 1.30% | 3.8% | 5.3% |

| WA (Perth) | $513,598 | $387,658 | 0.90% | 4.1% | 5.2% |

| TAS (Hobart) | $561,254 | $449,442 | 0.50% | 4.0% | 5.5% |

| SA (Adelaide) | $492,285 | $352,239 | 0.70% | 4.2% | 5.2% |

| NT (Darwin) | $465,976 | $309,181 | 0.40% | 5.2% | 5.5% |

| ACT (Canberra) | $734,107 | $492,968 | 0.60% | 4.3% | 5.4% |

Currently, capital city vacancy rates are very low nationwide and on a downtrend, with a national average of 1.9% in April 2021 compared with 2.1% in March.

The only capital cities that exceeded the national average were Sydney and Melbourne at 3.4% and 4.4% respectively in March. By contrast, Hobart and Darwin shared the lowest vacancy rate at 0.6%.

→ Discover The Property Hot Spots In Australia Right Now

Looking at vacancy rates and rental yields in each state may help you find an area that is relatively affordable while still delivering solid rental returns.

Desirability & Infrastructure

Beyond looking at the immediate supply, demand and vacancy rate of properties in areas that you’re considering investing in, you’ll also want to think long-term about how that area might grow in the future.

For example, most people looking to rent or buy in an area will firstly look at the employment opportunities in that suburb and in the surrounding areas. Additionally, people will look at the local council, nearby schools, public transport, and overall affordability of a suburb, as well as the crime rates and nearby recreational activities.

Below you can find a state-by-state breakdown of various desirability indicators:

| State | Transport | Nearby Schools | Crime Rates | Local Council |

| NSW | NSW transport | NSW Schools | NSW Crime | NSW Council |

| ACT | Act transport | ACT Schools | ACT Crime | NA |

| WA | WA transport | WA Schools | WA Crime | WA Council |

| SA | SA transport | SA Schools | SA Crime | SA Council |

| TAS | TAS transport | TAS Schools | NA | TAS Council |

| NT | NT transport | NT Schools | NT Crime | NT Council |

| QLD | QLD transport | QLD Schools | QLD Crime | QLD Council |

Conversely, if there is new construction planned near your area, such as a highway extension, it may negatively impact noise pollution and drag the value of your property down. These are all factors that will contribute to that area’s future growth. If a State government or local council has just announced new infrastructure plans or announced an upcoming shopping centre being developed in that area, it’s likely that that area will increase in value over time.

It can often be better to invest in a suburb’s potential rather than how successful it already is.

Conclusion

When trying to find great deals it’s important to analyse the numbers to ensure that your investment makes sense. Have your eyes on the various key indicators and you will be able to hone in on potential great deals.

You don’t have to spend millions or max out your borrowing capacity to build wealth through property, you simply have to have your eyes on the right indicators to determine whether an area is going to be attractive over the long term.

Sometimes it’s best to do as Wayne Gretzky suggests and “skate to where the puck is going, not where it already is.”

Find Undervalued Properties

Searching for the next high-growth suburb is important if you want to maximise your profits and avoid maxing out your borrowing capacity, however, you can increase your profits even further by finding undervalued properties.

At DG Institute we teach strategies that can be implemented where you’ll find undervalued property no matter the market conditions. Our strategies will teach you how to potentially find a property that is 10-40% below market value.

If you’d like to find out more, sign up for our free Real Estate Rescue course.

You May Also like to Read

Unlocking Potential: Uncovering Hidden Gems in Australia’s Property Market

Welcome to this edition of Property Edge, where we delve into the latest trends and insights shaping the Australian property...

Suburbs on the Rise: Property Searches Indicate Growth Potential

Welcome to the latest edition of Property Edge, where we delve into the dynamic world of real estate. In this issue, we...

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week's edition of Property Edge, where we delve into the current state of the property market through the...

Foreign Investment In Australia’s Residential Real Estate Is On The Rise

Welcome to this week's edition of Property Edge, where we delve into the latest trends and developments in the Australian...

How Far Australian House Prices Have Soared Above Fair Value

Welcome to the latest edition of Property Edge, your definitive source for insights into Australia's dynamic real estate...

February Home Price Movements Across Australia

Welcome to another edition of Property Edge, your definitive source for insights into the Australian property market. This...