How Much Does it Cost to Build a House in Australia?

Published 5:17 am 15 Sep 2021

The Australian dream has always been to own property, but why not build your own?

Building a new home in Australia has a lot of benefits, which is why more and more Australians are choosing to do it.

This is because when you build your own home you are the director. You can choose the style of place you’d like, how energy efficient it is, as well as the materials used while developing the property.

Many Australians came to this conclusion over the past year and a half thanks to the introduction of the HomeBuilder Grant which provided Australians with $15,000-$25,000 grant to either build a new home, substantially renovate an existing home or buy an off the plan home/new home.

The introduction of HomeBuilder saw the biggest quarterly contribution by residential construction since 2003 at the beginning of 2021, and a record 136,600 single home approvals during the 20-21 financial year – a 31% increase over the prior financial year.

While the HomeBuilder Grant has since ended, there are still grants available for Australians looking to build their home, and plenty of additional reasons to build rather than buy an existing property.

But first, there are a few things you should know before embarking on the house building journey in Australia.

Building a house in Australia is more expensive during COVID-19

Unfortunately for those looking to build their own home in Australia, COVID-19 has not been favourable as far as costs go.

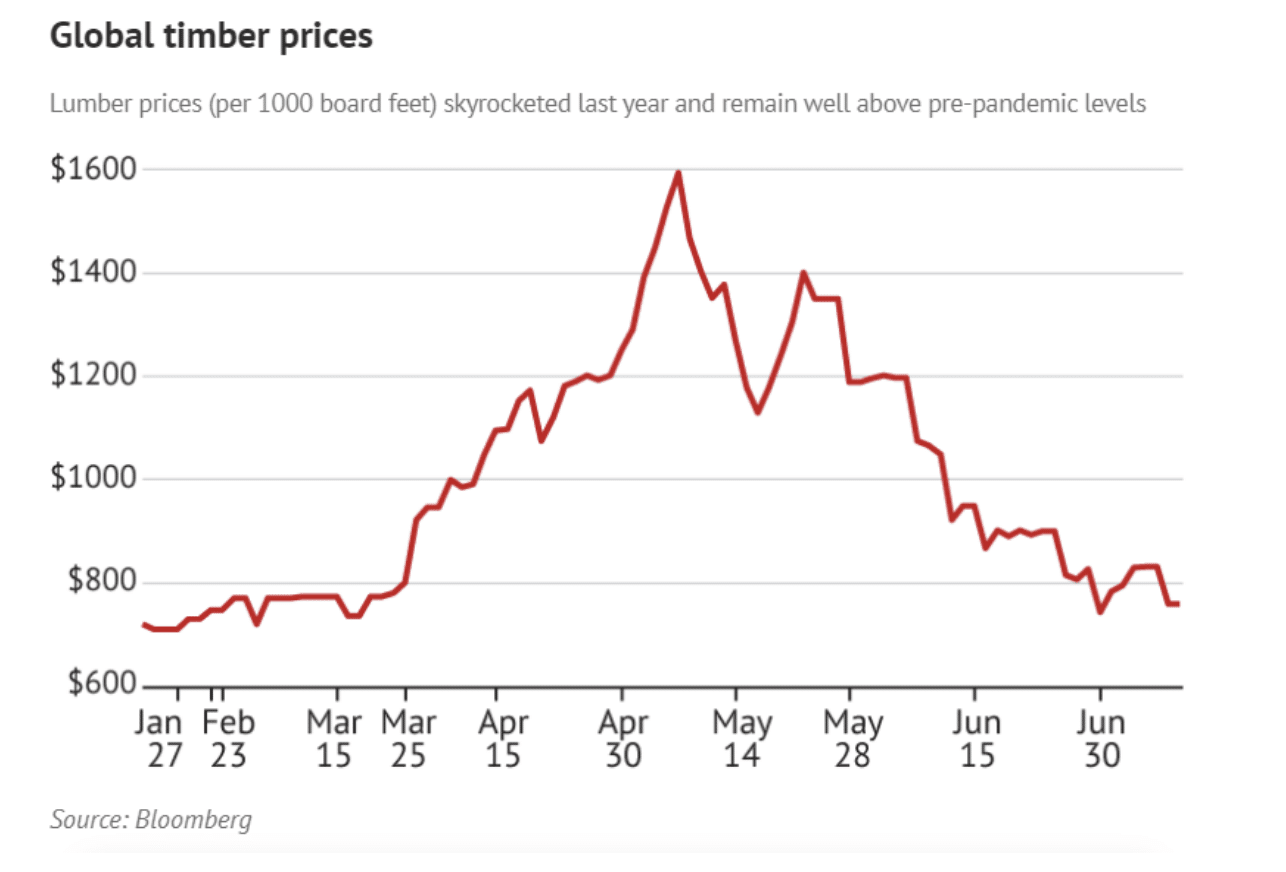

For starters, the cost of timber globally skyrocketed during the COVID-19 pandemic, prompting JP Morgan to predict harsh impacts upon housing construction over the next few years:

“We believe shortages could significantly influence … housing construction in Australia over 2021-23.”

Prior to COVID-19 and the subsequent border closures, roughly 20% of Australia’s structural timber came from abroad, mostly from Europe. However, much of that timber is now going to the US to fuel America’s current housing boom.

Moreover, although Australian timber prices didn’t rise as much as they did in other parts of the world, prices have still risen 30-40% and are expected to continue to rise throughout September.

According to a Sydney Morning Herald article:

“Major timber suppliers in Australia have notified Mr Bindon, managing director of ASX-listed timber seller Big River Industries, [that] they expect further price rises in August and September, though he doesn’t expect an increase of more than 50 per cent from the pre-COVID norm.”

HomeBuilder – A double-edged sword

In addition to timber shortages, the enormous success of the HomeBuilder scheme has driven up prices and delayed construction times.

Jon Stoddart, managing director of residential construction supply company Stoddart Group has said that:

“Any builder right now, will be saying to customers there are extended lead times. Everyone is under enormous pressure, and you’ve got people locked up [due to] COVID,” Mr Stoddart said.

“I’ve never seen so much stress in the industry, and I’ve been here since the ’70s.”

With all of that said, let’s look at the cost of building a home in Australia.

Cost of building a new home in Australia

The price of purchasing a house in Australia has skyrocketed during COVID-19, with cities like Sydney seeing property prices rise by more than $1200 per day over the past quarter to a median of $1,410,133. With houses growing less affordable by the day, outpacing even the highest salaries, building a home can be preferable as it’s often significantly cheaper.

By comparison, the average cost to build a house in Australia in 2018 was $1393.55 per sqm, equating to roughly $313,800 to build a house.

While these prices don’t factor in the price increases we mentioned earlier, it’s still significantly cheaper than buying an existing home.

However, there are also a lot of costs that come with building a home from scratch, including:

- The cost of land, which may include soil tests and levelling the land if it’s on a slope

- Building costs

- Permits, licenses, inspections, earthwork and potentially demolition or drainage

- Ensuring the property is protected against floods and bushfires

- Stamp duty

- Rainwater tanks

- Fences

- Rent you may pay while your house is being built

However, to simplify the equation, the most common metric used to determine the cost of building a home is cost per square metre (sqm).

Roughly speaking, building a home in Australia costs $1400 per square metre to $5000+ per square metre.

Now, these are 2019 costs, and the actual range is likely a bit higher than that given the aforementioned COVID-19-related additional expenses.

The reason there is such a variation in cost is due to several factors, such as the location of the build, the quality of your finishes, which materials you choose to use and the labour costs associated with the build.

How much does it cost to build a home in Sydney, Melbourne, Brisbane, Perth, Hobart, Adelaide, Darwin or Canberra?

The costs involved with building a house will vary from state to state, with one variable being labour costs. Below is a rough guide on the hourly rate for construction work in each state:

| State | Average labourer cost per hour |

| NSW | $45 – $55 |

| VIC | $35 – $45 |

| WA | $30 – $40 |

| SA | $35 – $45 |

| QLD | $35 – $45 |

Source: Oneflare

You’ve then got the cost of land, which again varies from state-to-state.

Land in Sydney, for example, costs $1,285 per sqm, while land in Melbourne costs $819 per sqm. You can find out more about the cost of land in the The Urban Development Institute of Australia (UDIA) State of the Land report.

With that said, below is a rough outline of the costs of building a house throughout Australia.

| State | Low range cost per m2 | High range cost per m2 | 2017–2018 average floor area m2 | Low range total cost | High range total cost |

| NSW | $1,780 | $5,100 | 220.5 | $392,490 | $1,124,550 |

| VIC | $1,720 | $3,300 | 246.4 | $423,808 | $813,120 |

| QLD | $1,800 | $4,000 | 231 | $415,800 | $924,000 |

| SA | $1,580 | $3,450 | 199.2 | $314,736 | $687,240 |

| WA | $1,400 | $2,700 | 236.5 | $331,100 | $638,550 |

| NT | $1,800 | $2,800 | 192 | $345,600 | $537,600 |

| ACT | $1,700 | $3,400 | 242.5 | $412,250 | $824,500 |

Source: Budget Direct

Average time to construct a home in Australia

There are many variables associated with the time it takes to construct a house in Australia, making it virtually impossible to give an accurate time to build a house.

For starters, there are the ongoing construction delays associated with COVID-19, adding further uncertainty to predicting the duration of each house build.

Then, there are the unforeseen hurdles that can arise when building a house, such as issues with soil, rock removal, bad weather conditions, waiting for certain approvals and so on.

Having said all of that, the average time to build a two-storey house is roughly 12 to 16 months according to Build Search.

That timeframe can be shortened if you’re looking to build a fre-fab, modular or kit home as opposed to working with an architect, and can also be lengthened depending on how many storey’s your planned property is, and whether it’s a “turnkey” property.

A turnkey property is one that is fully renovated, which can be immediately moved into or rented out to tenants. Put simply, a turnkey property is a “move-in” property.

Government grants to build a home

While the HomeBuilder Grant subsidy ended in April, there are still other subsidies available for those looking to build property in Australia, varying on which state you live in.

New South Wales: The First Home Owner Scheme is available for those that buy or build their first home, providing them with $10,000 to be spent on a house, townhouse, apartment, unit or similar that is newly built, purchased off the plan or substantially renovated.

As per the NSW Government site: “If you purchase vacant land and sign a building contract with a builder then we add the value of the vacant land plus the value of the building contract plus the cost of any building variations done together. The total combined cost must not exceed $750,000.”

Victoria: The VIC government also has a First Home Owner Grant (FHOG), which provides $10,000 to those that are buying or building their first new home valued at up to $750,000.

Western Australia: The WA Government also offers a one-off payment of $10,000 to first home buyers that purchase or build a new property as their principal place of residence if the house is less than $750,000.

South Australia: South Australia residents may be eligible for a grant of up to $15,000 on the purchase or construction of a new residential home in South Australia if the market value of the property is $575,000 or less.

Tasmania: First home buyers who are building a new residence or purchasing a newly built residence may be eligible for a grant of up to $30,000.

Queensland: Queensland’s First Home Buyer Grant provides $15,000 towards buying or building a new house, unit or townhouse valued at less than $750,000.

Northern Territory: If you are building a new home in NT you can apply for a First Home Owner Grant (FHOG) of $10,000.

Tips for choosing the right builder in Australia

One of the most crucial components to building a house in Australia and ensuring you stay within budget is to find a builder that you know and trust. Simple construction mistakes can quickly add up to thousands of dollars in expenses that you wouldn’t have needed to pay with a more experienced company.

As such, you should look into the portfolio of each company to see what other projects they have completed, how much they cost, whether they stayed within budget and what the timeframe was to complete the project.

It can also be helpful to ask for references to get a more comprehensive understanding of the company that you’re looking into.

Lastly, you’ll want to make sure that the company you’re thinking about working with for your project has all the requisite licenses and insurances needed to complete the job legally, so you avoid any hurdles along your journey that might add to the end cost.

However, before any of this you should ensure you have a solid plan in place so that each company you approach has clarity around what you’d like them to do and what their likelihood of achieving your goals is.

If you’re struggling to find reliable builders in your state, don’t worry. We’ve got you covered:

You May Also like to Read

Property Development Finance 101: Everything You Need to Know

Are you trying to learn how to finance your next property development? Don’t worry, in this article we’ll cover all of...

Australia’s Hidden Economic Crisis

On the surface, Australia’s economy seems to be on the rebound from COVID-19. However, when you dig a little deeper,...

Australian Wages See Biggest Drop in 20 Years

Australians are now getting less bang for their buck than ever as ABS data finds wage growth is at record lows. On...

How To Make Huge Profits Through Property Development

Have you ever considered doing a small property development? Here are a few reasons you should quit considering it, and just...

NSW Bans Construction Amid Rising COVID-19 Cases

A ban was placed on all non-urgent construction within New South Wales amid rising COVID-19 cases. Cases of the Delta...

Four reasons now is a great time to get big profits from small developments

COVID-19 may have put housing prices into decline, but there’s still money to be made in the property market. By carrying...