Feastudy for PC

Published 4:41 am 20 Oct 2017

Thank you for confirming your PC preference.

We will pass on this information and you will received your link to download the software within 7 days.

Below is some more information on the Feastudy product

Property Feasibility Studies Made Easy on a PC

Imagine undertaking financial feasibility studies for property development projects and property investments with consummate ease on your desktop, laptop or notebook, i.e. without much prior feasibility software tuition but with plenty of ‘thinking’ already done for you and lots of easily-accessed help available to you.

Feastudy 10 is updated for the 2018 “GST at Settlement” laws. Consequently, the program assumes that, at the settlement of each purchase of a “new Residential property” from a GST-registered developer, the purchaser must remit to the Australian Taxation Office (ATO) either: seven per cent (7%) of the purchase price of that property if the Margin Scheme (MS) applies to the transaction; or all of the GST that applies to the purchase price of that property if the Full Taxation (FT) method of GST applies to the transaction.

Feastudy 10 Lite

Feastudy 10 Lite is an industry-standard software tool for developers and valuers to investigate:

-

- The financial feasibility of undertaking property development projects.

- Residual land values for property development sites.

Feastudy 10 does not even require a knowledge of how to use Microsoft Excel because Feastudy 10 run independently of it.

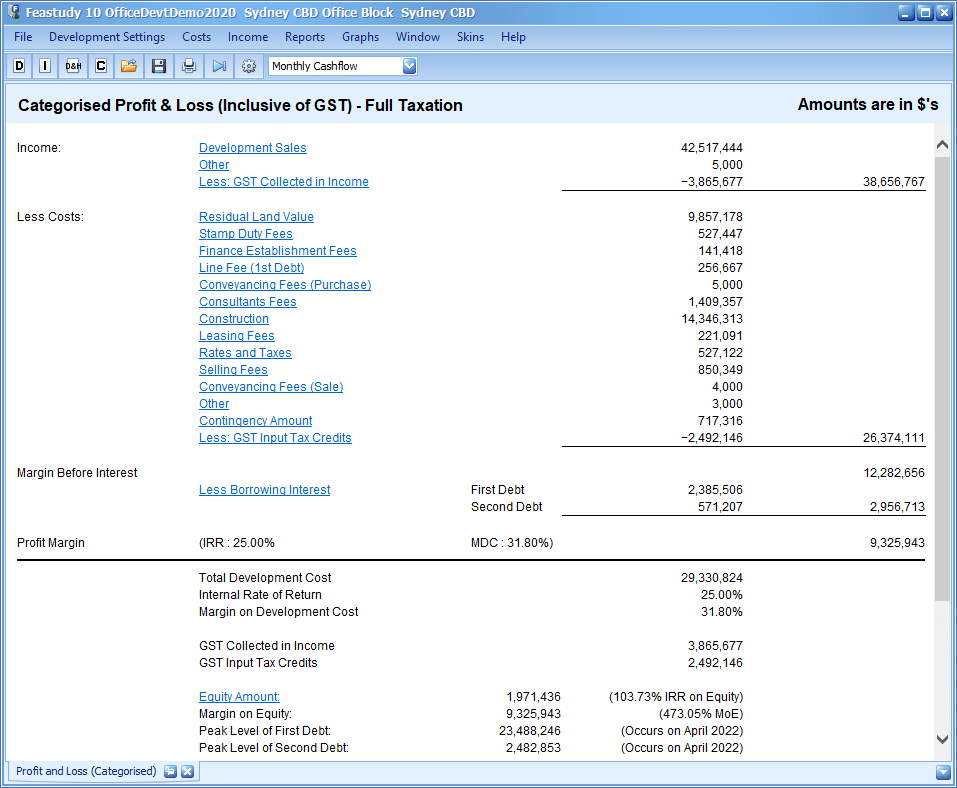

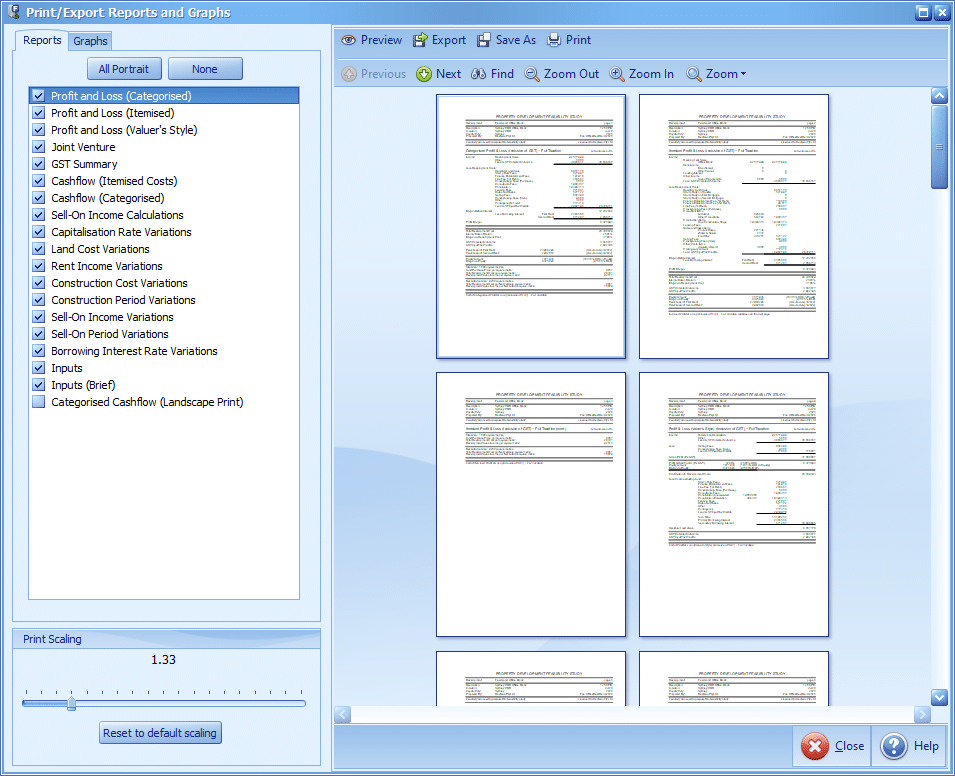

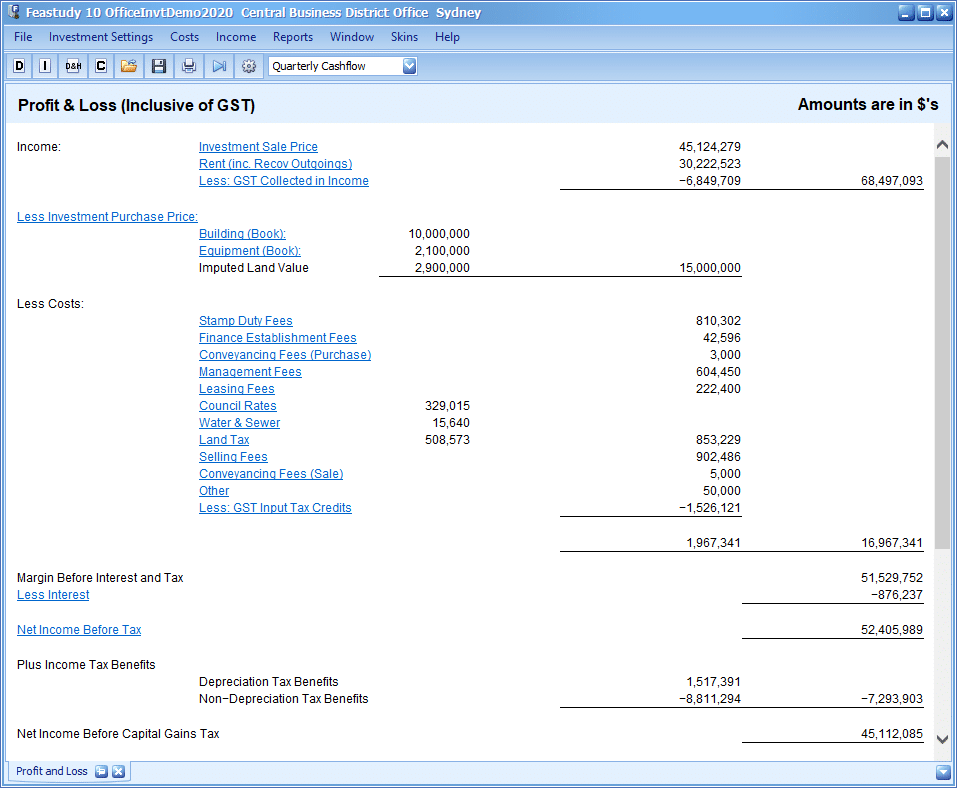

Feastudy 10 can quickly, accurately and comprehensively calculate and display the following reports for all types of development proposals:

-

-

- Three types of forecast profit and loss statements (including margin and internal rate of return information).

- GST summary.

- Categorised cashflows and itemised cost cashflows for monthly intervals.

- Sensitivity analysis tables for variations in up to and including eight critical variables (such as construction cost and interest rates).

- Inputs details.

-

Graphs for development proposals are also available for viewing on-screen and printing to paper.

When the user enters his or her required IRR and/or margin criteria, after all, other relevant variables have been entered Feastudy 10 can be used to help determine the residual value of a development site for a particular development proposal.

You May Also like to Read

Property Development Finance 101: Everything You Need to Know

Are you trying to learn how to finance your next property development? Don’t worry, in this article we’ll cover all of...

Australia’s Hidden Economic Crisis

On the surface, Australia’s economy seems to be on the rebound from COVID-19. However, when you dig a little deeper,...

How Much Does it Cost to Build a House in Australia?

The Australian dream has always been to own property, but why not build your own? Building a new home in Australia has...

Australian Wages See Biggest Drop in 20 Years

Australians are now getting less bang for their buck than ever as ABS data finds wage growth is at record lows. On...

How To Make Huge Profits Through Property Development

Have you ever considered doing a small property development? Here are a few reasons you should quit considering it, and just...

NSW Bans Construction Amid Rising COVID-19 Cases

A ban was placed on all non-urgent construction within New South Wales amid rising COVID-19 cases. Cases of the Delta...